Articles

| Name | Author | |

|---|---|---|

| Case Study: Fuel Management at Ukraine International Airlines | Andriy Kostyuk, Technical Pilot E-190, Ukraine International Airlines | View article |

| Aviation and the Environment | Guido Harling, CEO ETSverification GmbH | View article |

| Norwegian EFB: to buy or build? | Klaus Olsen, EFB Administrator, Norwegian | View article |

Aviation and the Environment

Author: Guido Harling, CEO ETSverification GmbH

SubscribeAviation and the Environment

Guido Harling, CEO, ETSverification GmbH offers an Introduction to CORSIA & Aviation’s EU ETS’s Future in Europe

In this article, we take readers into the field of aviation environmental regulations. It’s a voyage into the unknown and I’ll be sharing some bad news about the reality of two systems involved in this, but it won’t all be doom and gloom: there will be a silver lining at the horizon

ETSverification GmbH

ETSverification GmbH is, as the name suggests, a verification body for greenhouse gas emissions delivering GHG audit and verification services to airlines, airports, shipping companies – a new addition to Europe’s strategy to combat greenhouse gas emissions – and air cargo security verifications. This is all possible because we are an EU wide accredited Verification Body under DIN EN ISO 14065.

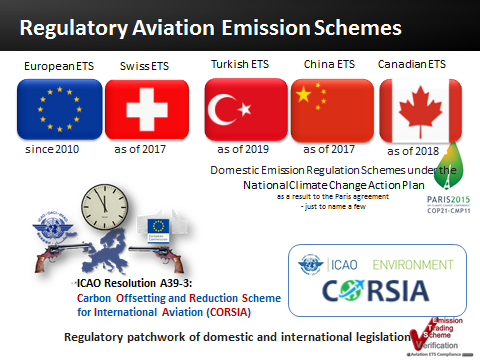

THE CURRENT REGULATORY LANDSCAPE

Readers will know about the EU-ETS (the EU’s Emissions Trading Scheme) for aviation that has been in operation since 2010. Figure 1 shows how a number of other states have aligned their own emissions trading schemes with the EU ETS in the years since.

Switzerland has started to link its own GHG regulating scheme to the EU ETS. Switzerland was formerly a safe haven, as flights into or out of Switzerland to any EU country were not included in EU ETS Intra-EU reporting scope. However, things have changed here: as of 2017, airlines and operators landing in Switzerland have had to submit a monitoring plan and in 2018 those flights will be counted, firstly to create a payload report. By 2019, we assume flights to and from any Swiss airport to any EU country will also be included in the Intra EU reporting scope and thus subject for offsetting (surrendering carbon certificates). That’s one part of the new landscape but there are others.

In 2019, Turkey is looking to set up its own GHG (greenhouse gas) regulation scheme that will also include aviation plus China and Canada, to name a few, are also looking to establish their own schemes. Those schemes emanate from the UNFCCC (UN Framework Convention on Climate Change) Climate Conference Accords, the 2015 Paris agreement COP21 (21st Conference Of the Parties) where the global framework was agreed that the world’s temperature should not increase by more than 2 degrees C.

How countries can achieve this standard is by setting up their own local ETS schemes or plans, including many more than at the top of figure 1. Right now, countries of the world are trying to fulfill their commitments made from the Paris Climate Agreement. Emissions from domestic traffic have been always included in the UNFCCC (Kyoto before and Paris now), but the international traffic was excluded. Until now. The GHG reductions from international aviation will be governed by ICAO from 2019.

Figure 1

And here is another elephant in the room, ICAO and the slow birth of CORSIA, the Carbon Offsetting and Reduction Scheme for International Aviation. There was a stand-off between Europe and ICAO (International Civil Aviation Organization) in 2012 as Europe enforced its own ETS on aircraft operators and, as a result, ICAO reacted at ICAO Assembly 39 in 2016 and devised CORSIA. We will now take a close look at what is involved with both schemes and how aircraft operators are impacted. As figure 1 shows, it is a patchwork of legislation with which airlines and operators will have to work with.

THE NEAR-TERM TIMELNE

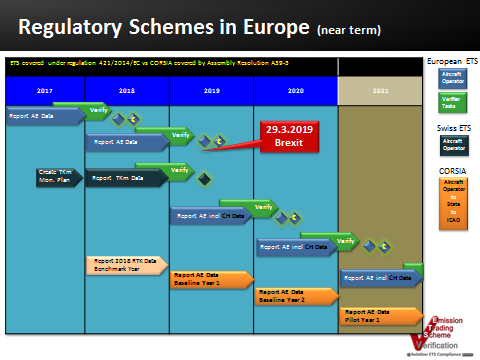

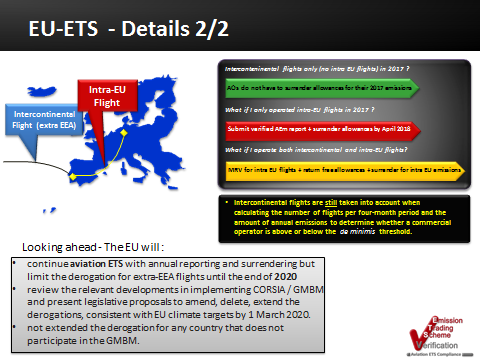

As you’ll see, figure 2, EU ETS is covered by regulation (EU) 2014/421 (and just recently appended by regulation (EU) 2017/2392) whereas ICAO’s CORSIA is covered by the ICAO resolution A39-3.

Figure 2

EU ETS

Staring with EU ETS, let’s look at what operators and auditors have been doing since 2010. There are two deadlines to remember. The first deadline is always on March 31 each year when airlines need to submit a verified initial report; the second deadline (identified by the € in a diamond at Figure 2) is the point in time when carbon credits or certificates or allowances (they’re all the same) have to be handed in to the European authorities to offset the emissions from Intra EU flights flown in the previous calendar year. This process repeats itself every year. As already mentioned, Switzerland is linking its emission trading scheme with the EU, so at the moment, operators have to submit a monitoring plan to the Switzerland Competent Authority to say how they are doing things, how they are monitoring Tonne-Kilometres; then, in 2018, aircraft operators have to submit a Tonne-Kilometre (TKm) report. The intricacy of a Tonne-Kilometre report as opposed to an annual emissions report is that the TKm report is actually the airline’s application to receive free allowances or free carbon credits because, if they had to account for and pay for all the carbon emissions that their aircraft produce, all airlines would go out of business: there is a certain percentage that aircraft operators receive for free. Free allowances are the additional lever with which Europe tries to regulate and decrease the amount of emissions that are created by every year reducing the amount of free emissions given to aircraft operators.

From 2019, aircraft operators impacted by EU ETS will have to submit an annual emissions report that includes flights from and into Switzerland, previously excluded so there will need to be an aviation emissions monitoring system update to take account of that change. That will continue until 2021, at least.

CORSIA

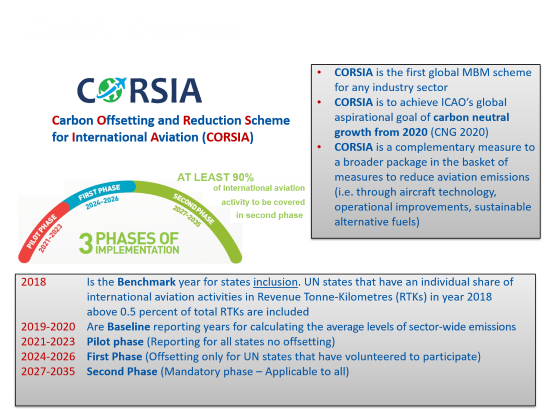

But now there is a second regulation scheme, the global one – CORSIA. The CORSIA regulations start in 2019 with a Benchmark: the 2018 RTK (Revenue Tonne-Kilometre) report that ICAO will receive from the states who, in turn, will receive the data from the aircraft operators and that will determine whether a state that is a member of the United Nations will be included in or excluded from CORSIA. The inclusion/exclusion dilemma refers only to the offsetting part of CORSIA. All ICAO Member States must monitor emissions from international air traffic and send an emissions report to ICAO Secretariat. The routes to/from States that represent below 0.5 per cent of the overall reported RTK (Revenue Tonne-Kilometre) worldwide or with no aviation activity will be excluded from offsetting. Then, the two years 2019 and 2020 will be the Baseline years. Basically, ICAO’s idea of CORSIA is that they want to limit greenhouse gas emissions from aviation activities to the levels of 2020, hence the need for a benchmark averaged over the two years. Of course, air traffic and the world economy will grow beyond that, but ICAO takes the view that there cannot be any more emissions than the level of their benchmark (Carbon neutral Growth 2020). From that, CORSIA will start with a pilot year in 2021.

Brexit

And there is one more thing that will impact the regulations: Brexit which will fall before the deadlines for the 2018 reporting year. The British Government is undertaking a consultation, in which I am participating, to minimize the impact of Brexit in this area, i.e. the treatment of UK-based airlines under the regulations.

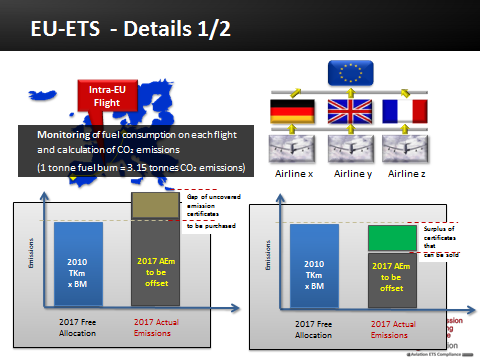

EU-ETS VS CORSIA IN DETAIL

EU-ETS has been working since 2010 applying to any airline that flies to, from or within European Economic Area (EEA) or is regulated by an EU member state. For these airlines, their emissions credits and payments for emissions are regulated by Europe but it deals with intra-EEA flights only. Airlines have to monitor the emissions and calculate the fuel burn times 3.15 to arrive at the carbon dioxide that has been emitted for entry into a report to present to the auditor as the annual emissions report. Those annual emissions for the year, say 2017, depicted in the brown bar (figure 3.1) with yellow font are the actual emissions that need to be offset.

Figure 3.1

Some of these offsets will be covered by the airline’s free allocation. The total emissions will either be more than or less than the free quota and, since it’s a ‘cap and trade’ system, the airline can either buy carbon certificates or credits in the market or can sell them if they have undershot their emissions target. The idea is to encourage airlines to optimize their fleets and operations, consider alternatives such as bio-fuels… in other words, the scheme aims to spur innovation.

There is one caveat: The regulation covers intra-EU flights but also intercontinental or extra EEA (European Economic Area) flights must be taken into account (figure 3.2) because…

Figure 3.2

The intercontinental flights are important because in order to determine whether an airline is impacted by ETS, the full scope, all flights including the intercontinental ones are taken into account.

What will happen to ETS in the future? The EU Regulatory Proposal says it will:

- Continue aviation ETS with annual reporting and surrendering but limit the derogation for extra-EEA flights until the end of 2020 after which the EU will closely participate in the ICAO procedures to assess how it is developing and…

- Review the relevant developments in implementing CORSIA / GMBM (Global Market-Based Measure) and present legislative proposals to amend, delete, extend the derogations, consistent with EU climate targets by 1 March 2020, after which, I suspect, the systems will merge;

- The EU will not extend the ETS derogation for any country that does not participate in the GMBM.

Looking now at CORSIA (figure 4) it is a Global Market Based Mechanism for the aviation industry aiming at carbon neutral growth from 2020 so that any other growth in the sector, say air traffic volumes, will have to be combatted or offset through the mechanism. The mechanism is a basket of measures with the aim to encourage aircraft technology innovation, use of sustainable aviation fuels, etc. but also the process of offsetting using carbon credits.

Figure 4

2018 will be the benchmark year for a state to either be included or not – states below 0.5 per cent of the overall reported RTK worldwide or with no aviation activity at all are excluded. The scheme itself applies world-wide, not only in Europe, so the years 2019 and 2020 are world baseline years for all states to determine the overall aviation emissions on which the scheme will be based. 2021 to 2023 will be the pilot phase involving all UN states but the CORSIA scope will only mandate the submission of a verified emission report. The years 2024 to 2026, marking the 1st phase will include mandatory emission reporting for all states and offsetting of emissions (will be explained further down) for states that volunteered to participate. Finally, from 2027 to 2035, the scheme will be mandatory for all states.

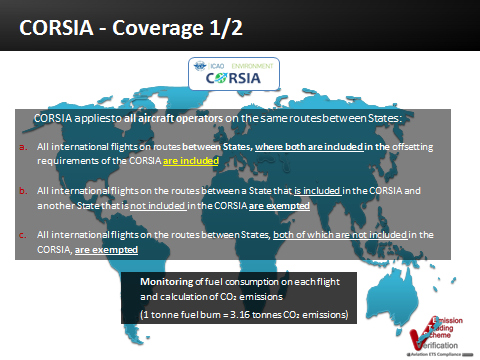

Figure 5.1

CORSIA route coverage is simple; if the airline’s home state and the state to which it is flying is included, the route both ways is included and the airline will need to monitor, report and offset the CO2 that is emitted on that route. (figure 5.1). If the home state is included but the state to which the airline is flying is not or if both states are not included, the route is exempt. It’s similar to ETS inasmuch as 1 tonne of fuel burn is calculated to produce 3.16 tonnes of CO2 emissions (EU-ETS calculates 3.15 tonnes of CO2 emissions for every 1 tonne of fuel burned).

Figure 5.2

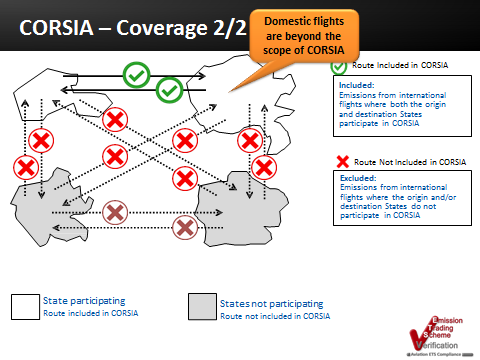

Looking at coverage from a different angle (figure 5.2), it can be seen that only if both states are included will flights between them need to be reported. But that will generate problems because intra-state flights, domestic routes, are included in ETS but not in CORSIA.

How offset will be calculated in CORSIA will be different from ETS. It will start with the aircraft operator monitoring emissions and sending a verified emissions report to their State Authority every year. States will consolidate the emissions data for all aircraft operators under its jurisdiction before reporting it to ICAO who, in turn, calculates a Growth Factor which is communicated back to the airline. The airline takes the reported emissions and multiplies it by the Growth Factor and those are the emissions that have to be offset, called the individual airline offset requirement. That Growth Factor is taken from the two baseline years, 2019 and 2020, and this is what ICAO will communicate to the individual operator.

How airlines can actually offset differs from ETS which creates carbon credits that it sells to airlines – a good revenue stream. The aircraft operator is made aware of the quantity of emissions that have to be offset and will have to buy emission units, Certified Emissions Reductions (CERs), which are tradeable. The current price for CERs is lower than the EU emission allowance. Each emission unit is designed to offset 1 tonne of carbon dioxide. The airline buys them, reports the purchase to ICAO and their obligation is covered.

An emission unit comes from a project that takes carbon dioxide out of the air such as planting a forest, or projects that reduce CO2 emissions (renewables, clean tech, electric transportation) where it is possible to measure the carbon dioxide that will be taken out of the air as the forest grows. Such projects yield certified emission reductions which can then be bought.

MRV

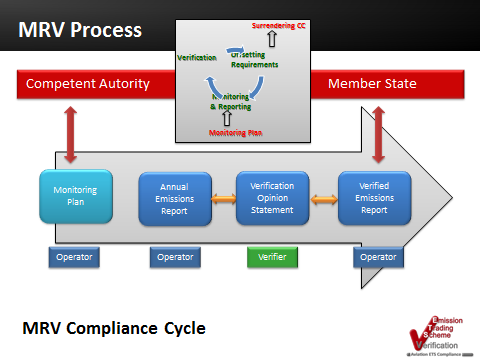

Now, building up to that silver lining mentioned earlier, there is a common denominator. Even though we see overlapping regulatory greenhouse gas schemes: the EU emission trading scheme and the ICAO scheme, and I foresee that ETS and CORSIA will co-exist for some time. The common denominator is that all those data will have to be audited and, for all of those audits, MRV will be needed. MRV is Monitoring, Reporting and Verification, the common audit process that, once you stay on top of it, will not be that difficult (figure 6).

Figure 6

The MRV process explained in brief is that the airline has a monitoring plan in which they tell their authority, state or EU competent authority, how they are recording and measuring emissions. Then the airline goes through the year and records emissions which are delivered to an auditor who will provide the verification and produce an attestation and audit certificate which emission report is then all provided to the airline’s regulator – ICAO for CORSIA or the EU for ETS. At the very end the airline will surrender carbon credits (EU ETS) or offset the share of reported emissions (ICAO CORSIA)

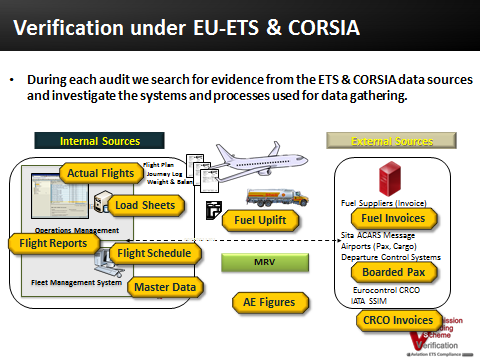

What auditors will look at in an airline can be seen in figure 7.

Figure 7

The audit takes account of load sheets, fuel invoices, passengers… The green bar in the middle is the important one because it is where the MRV process starts and what any tool used by an auditor and/or employed by an airline will need to have access to or derive data from. In MRV, there are tools employed at an airline, tools employed at the competent authority under, say, ETS, and then there are tools that record the offsetting, the surrendered carbon credits to cover any extra emissions that have been produced.

WHAT YOU SHOULD TAKE FROM ALL OF THIS – THE SILVER LINING

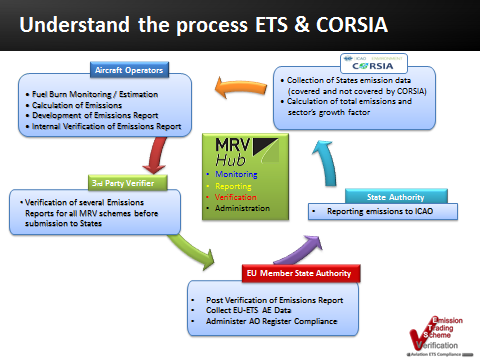

Starting with the process (figure 8) under ETS and under CORSIA.

Figure 8

It starts with the aircraft operator monitoring and reporting its flights and fuel figures; this data will be provided in a standardized format to the third party verifier; then the information is sent to either EU-ETS and to the regulating state who will report it to ICAO, who will communicate back to the aircraft operator the Growth Factor for offsetting. In the middle of this, is or will be a tool that can communicate to all parties, EU and ICAO (as an example we depict the MRV Hub from ETSaero).

CLOSING COMMENTS

Stay on top of the process

My advice to readers is simple. Speak to your Civil Aviation Authority about CORSIA requirements, especially UK regulated airlines because, at the time of writing, the UK EU relationship it this area had not been settled. Also, learn about what ICAO is designing with regards to monitoring and reporting.

Urge your CAA to implement future Annex 16 Volume IV on time so it can send consolidate emissions reports for 2019 and 2020. The lack of emissions data may impact the 2019-2020 baseline making it lower that it is. This gap may result in higher offset requirements, thus increasing airline compliance costs.

Involve your verifier

Work closely with your auditor because deadlines will shift, in the case of UK operators because of Brexit. Schedule your ETS verification and discuss upcoming CORSIA verifications – monitoring and reporting requirements.

Be smart about tools

Implement MRV software that can support multiple regulatory emission schemes.

I could say good luck with these two major schemes but, in fact, if you plan ahead, get the right tools in place, cover all the steps and meet the timing requirements, you won’t need good luck and the whole process will become routine.

Contributor’s Details

Guido Harling

Guido Harling is the founder and executive director of ETSverification GmbH, the verification body for the aviation industry. He holds both a bachelor of science and a master of business degrees and is IRCA accredited ISO 9001, 50001 auditor and ISO 14065 greenhouse gas verifier. Guido started his career in North America with KPMG. Since 2005 he has been managing projects for IATA. In 2009, with the emergence of EU-ETS he helped operators design and implement ETS and, in 2010, started ETSverification GmbH.

ETS Verification

ETSverification GmbH is a leading global expert in carbon verification and certification services for the transport sector, auditing airlines, business jets, airports and just recently maritime shipping under the ISO standard 14065/14064 and according to the current EU-ETS directives. ETSverification greenhouse gas (carbon) verifiers are renowned for their aviation expertise and for well-planned and executed verifications to comply with voluntary and mandatory standards.

Comments (0)

There are currently no comments about this article.

To post a comment, please login or subscribe.