Articles

| Name | Author | |

|---|---|---|

| The Smarter Supply Chain in MRO: Part 2 | Amol Salaskar, Consultant Business Analyst in Aviation and MRO, IBM Center of Competency | View article |

| The towering eye wall | Gesine Varfis, Marketing & Early Adopter Program for Maintenance Consulting, APSYS | View article |

| Digital Transformation — where we are today | Martin Harrison, Global Managing Director - Airlines, Aerospace and MRO, ICF | View article |

| Case Study: First Air – Implementing a Mobility Suite of Apps | Gail Campbell, Manager Technical Records & Trax Administration, First Air | View article |

| How I See IT – The choices paradigm | Allan Bachan, Vice President, ICF | View article |

Digital Transformation — where we are today

Author: Martin Harrison, Global Managing Director - Airlines, Aerospace and MRO, ICF

Subscribe

Although this article is about the current state of play with digital transformation in the MRO/M&E sector, we first provide the readers with some context about the industry and the latest developments.

FLEET TRENDS & MRO INDUSTRY CONTEXT

In this first section, we look at the evolution of the global fleet and why it matters for the MRO industry.

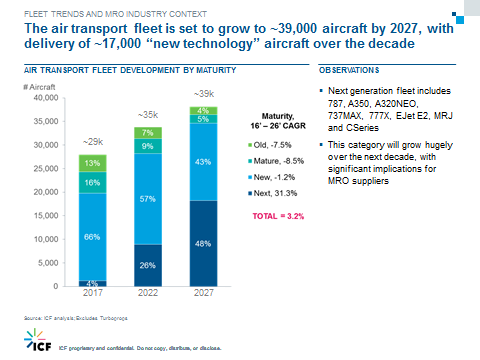

Figure 1

ICF segments the global fleet into four technology categories: Old, Mature, New and Next. The Next generation of aircraft includes the Boeing 787s, the Airbus A350s and the Bombardier CSeries (now Airbus 220) as well as the Boeing 737MAX and Airbus A320NEO, the Embraer E-Jet E2, and the Mitsubishi MRJ. These are new aircraft with enhanced data capability which has an important impact on people in maintenance in terms of what can be done with that data. Critically, these new generation aircraft are flooding into the fleets. Until just a couple of years ago, they only represented 4% of the global fleet but will very soon account for a quarter of the fleet and by 2027 for nearly half the global fleet.

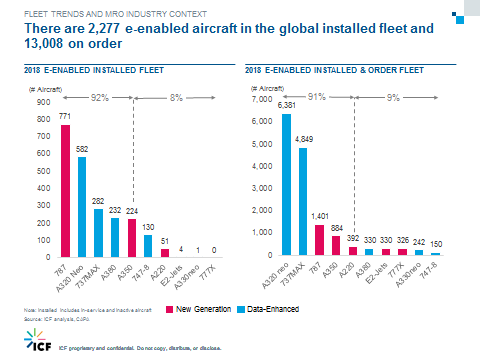

As per the below chart, we can see that the new narrowbodies (NEO and MAX) dominate the order book while the number of 787 and A350 in the global fleet will more than double.

Figure 2

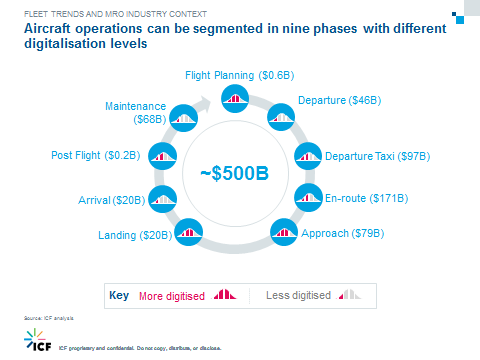

ICF has conducted a study to evaluate the airlines’ spend by aircraft operations and evaluate the digitalization level for each phase.

Figure 3

Doing this segmentation enables us to find out how much money is available to be saved as this is the ultimate goal for most people: save money/reduce operating costs. In order to make this assessment, we looked at, ‘how much of each activity is automated / supported by adequate IT tools?’

One of the key findings is that Maintenance has not been through much of a digital transformation: looking at a hangar 30 years ago compared to a hangar today, it looks quite similar for most airlines/independent MROs – Often, there’s still paper on racks, there are still people walking back and forth to the stores and there are still people standing in front of a machine looking at the IPC (Illustrated Parts Catalog). Maintenance activities are less well automated, less well digitalized than many other phases of service. This means that there are opportunities to try and improve maintenance and make it more efficient.

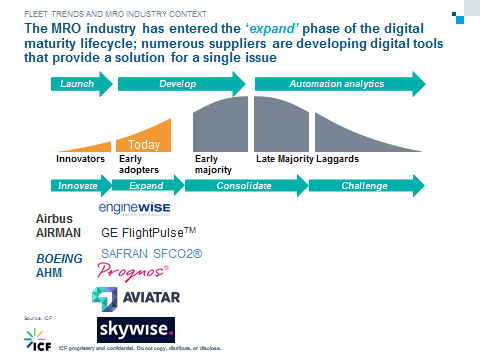

If we look at a classic cycle for adoption of new technology, we can see where we are currently in the maintenance world (figure 4).

Figure 4

There have been some early innovators doing things differently in maintenance. For example, when AIRMAN was introduced, it was possible to tell engineers about items that weren’t in the tech log, that the pilot did not know about, but that would help to figure out what was going to happen with the aircraft as opposed to just looking at what had happened in the past. Now, with new technologies, we’re in the ‘Expand’ phase with more and more solutions being brought to the market and this is why there’s a lot of interest in the topic today with lots of actors wanting to get into the digital MRO space.

ACHIEVEMENTS TO DATE AND NEW TECHNOLOGIES

To date, there have been limited success stories in the MRO digital transformation journey. For example, Skywise and easyJet claimed, in 2018, 149 successful pre-emptive maintenance actions (which does not seem to be a significant number compared to their flight schedule). This strengthens the fact that we are in the very early days of predictive maintenance and effective MRO digitalization.

When airlines talk about their digital successes, they often do so in the context of reliability and how it helped them improve the reliability of the fleet. But, if reliability has gone from 99.6 percent to 99.7 percent, how much money has been spent doing that and is it really that important?

Regarding new technologies, airlines and MROs have considered using drones to conduct inspections. However, drones cannot easily be used on the line because they are susceptible to winds meaning that if a drone gets caught by a gust of wind and hits the aircraft during a line inspection, it would create more problems than it might solve. Drones can only really be used in the hangar and, to date, they haven’t been used with any great success, only on a limited scale.

Similarly, a couple of years ago, everybody was talking about Blockchain but this is primarily about technical records and trying to have a better, more secured method of controlling those records. It is unlikely that Blockchain can save significant money, or significant level of resources for airlines and MROs. Another topic in the MRO space is the use of 3D Printing. While 3D-printing is in theory a great way of saving money, it is likely to be faced with similar challenges as those faced by PMA parts (e.g.: impact on lease returns). While it was thought that 3D-printing would be beneficial for airlines and MROs on cabin parts, it hasn’t taken off and it doesn’t offer realistic cost savings for most MRO industry players.

Considering the above ideas are not quite what the hype might have led us to think, the questions arise, ‘where can airlines and MROs save money? and where are the opportunities with the increasing amount of data becoming available?’

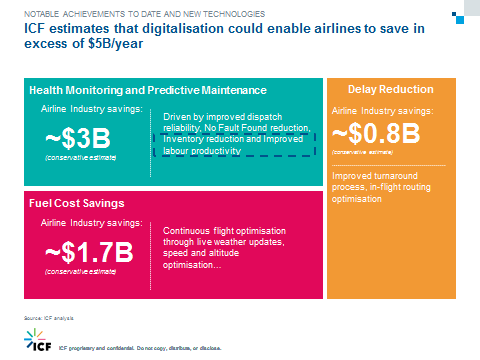

Figure 6

Fuel being a large part of an airline’s costs, anything that can be done to save a quarter percent or half percent on fuel costs is important.

ICF also believes, based on its research, that there are significant opportunities to save money in maintenance, but it’s necessary to focus on two areas.

– First of all, inventory represents a significant spend for airlines and MROs: cost of assets in the warehouse, in a pool agreement or on the balance sheet.

– The other key area of focus is labor. Labor is the second largest expense for airlines (partly because of people leaving the business and partly because licensed skilled labor is expensive) which means that finding technologies that enable the business to use labor more efficiently is a key area for cost reduction focus.

WHICH SUPPLIERS ARE LEADING THE RACE TO DIGITAL MATURITY?

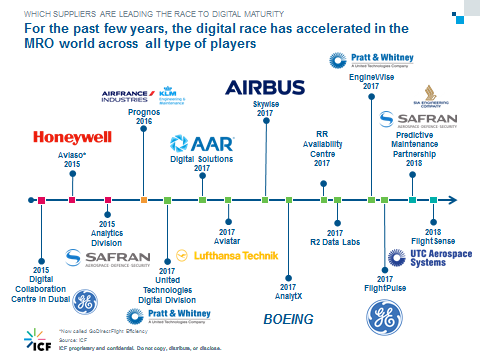

Airbus, Boeing, the large component manufacturers, the aero-engine manufacturers have all started offering services in the last two or three years as have the large MROs such as Air France Industries – KLM E&M and Lufthansa Technik. There are numerous players moving into this space, people who historically have wanted to sell aircraft and to sell MRO services now also want to sell digital analytics and other capabilities (figure 7.1).

Figure 7.1

The value stream to develop digital solutions can get quite complicated. As a result, industry players are wondering what to do, who to partner with, where to get the key building blocks (e.g.: data acquisition, engineering expertise and algorithms), who are the experts for each of them, etc.

Focusing on predictive maintenance as an example, the key question is whether the service provider really understands maintenance; do they understand the implication of a specific service bulletin? Do they understand how to manage and improve reliability? Do they really understand the system, not just the ATA but the systemic effect on the aircraft? How good are their engineers to help the operator use the information? In summary, ICF believes that the digital transformation of the MRO space has to be driven by maintenance experts supported by technologists but that technologists alone can’t succeed in this complex space.

A MORE PRAGMATIC VIEW

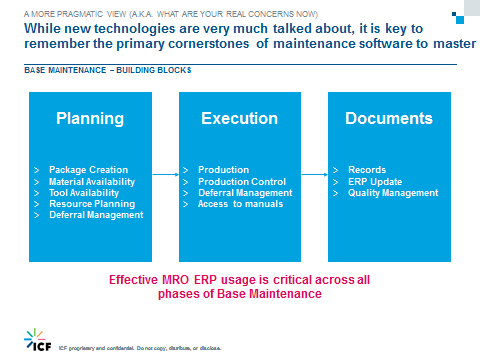

The aforementioned initiatives will eventually benefit the MRO industry (some will fail but overall new technologies will move the industry forward). However, in the short term, here and now, the key MRO industry challenges revolve around the usual three building blocks: Planning, Execution and Documentation.

Figure 8

While it sounds like maintenance 101, this remains a key challenge for organizations with experienced staff leaving while those remaining are trying to build the packages. The right tools are not always available nor the right consumables: and organizations are getting caught up with Deferral Management and staying on top of that, as well as staying on top of the MEL (minimum equipment list). This is still very much the life of Maintenance every day – in some respects, it is real life. It might be possible to be better at predicting component removals but every day all of the above (figure 8) still has to be done. So, when we look at the MRO system providers, what are they developing and what are the airlines asking them to improve: it is much more down to earth, it’s much more 1980s. After all this time, we’re still talking about paperless maintenance and digital signatures; but how many readers have a regulator who demands that a pen is used to sign off critical actions, records and communications: we’re still catching up with some of the basics.

Going mobile is a big theme and is probably the biggest revolution going on in airlines in general. Pilots were first with almost every airline now using an EFB (electronic flight bag) and flight attendants are next with an increasing number of airlines providing their attendants with iPads and mobile capability. But we are now starting to see maintenance staff getting iPads and that’s the revolution currently underway; more than predictive maintenance, it’s getting iPads to hand, swapping the Toughbooks for iPads that mechanics want to use. It’s really revolutionary because it means people don’t need to go to the stores, are not trying to look up information on old-fashioned internet systems. Part of that is offline capability, there isn’t always access to Wi-Fi when mechanics are out on the ramp so having an offline capability to access manuals, complete paperwork and sync it when it gets back on line, is useful.

Hands-free and touch screen is not necessarily new but we’re seeing it more, MRO is catching up. Inventory management is still very much manual, the industry has been talking about RFIDs for inventory management for years and yet it is rarely used, neither are other technologies. There is also the whole concept of digital twins and digital threads which is progressing slowly. Realistically, MRO/M&E is still catching up: the industry can think about what value can be derived from new technologies and more data but, for many players, investment is still required to catch up with some of the basics.

CONCLUSIONS

Our conclusion on the MRO digital transformation is that the buzz is still about predictive maintenance where progress is definitely being made but it might not change readers’ lives in the immediate term. The industry is yet to realize the benefits of Predictive Maintenance. Also, when considering with whom to partner, competencies have to be carefully evaluated – data acquisition, data storage, analytical capability and, most importantly, engineering expertise.

Finally, for most airlines, focusing on the core building blocks (Planning, Execution and Documentation), is where investment still needs to be made: getting iPads in, getting rid of paper, getting digital signatures.

Contributor’s Details

Martin Harrison

Martin Harrison, a Vice President at ICF in London, has been serving the aviation industry for more than 30 years. As a consultant, he works with clients around the world on operations projects that span tech ops, ground ops and flight ops. Prior to joining ICF in July 2012, Martin was COO at Pluna Airlines in Uruguay and has also held executive operational positions at Spirit Airlines and easyJet Airlines having started his career at British Airways

ICF

ICF is a global consulting services company with more than 5,500 specialized experts, who are not typical consultants. They combine unmatched expertise with cutting-edge engagement capabilities to help clients solve their most complex challenges, navigate change and shape the future.

Comments (0)

There are currently no comments about this article.

To post a comment, please login or subscribe.