Articles

| Name | Author | |

|---|---|---|

| Getting high value by spreading IT services | Dr Franck Duluc, Engineering & Maintenance Research Manager, Airbus | View article |

| How I see IT | Michael Wm. Denis, Vice President, Customer Engagement, InfoTrust Group | View article |

| Case Study: Documentation in the 21st Century | Julie Steadman, Principal Airworthiness Records, Virgin Atlantic | View article |

| MRO Networks | Michael Wm. Denis, Vice President, Customer Engagement, InfoTrust Group | View article |

| Case Study: A New MRO System for Qantas Engineering | Geoff Zuber, General Manager, Aerospace & Utilities, Holocentric | View article |

MRO Networks

Author: Michael Wm. Denis, Vice President, Customer Engagement, InfoTrust Group

SubscribeMichael Wm. Denis, Vice President, Customer Engagement, InfoTrust Group explains how new technologies are transforming old business models and increasing aircraft availability at lower total lifecycle costs.

On March 5, 2012, Pemco World Air Services filed for bankruptcy protection. Outside of the United States, this event probably went unnoticed but, over the past two years, several North American MROs have filed for bankruptcy. However, when, two weeks later, Aveos Fleet Performance Inc. (previously Air Canada Technical Services – ACTS) filed for bankruptcy protection under Canadian law, the aviation maintenance industry took note. The following day Aveos filed for liquidation, having consistently been one of the top-ten airframe, engine and component MROs in the world.

Even as these and other independent third party MROs teeter on the edge of existence, original equipment manufacturer (OEM) MRO networks are chalking up multiple deals with revenues and profits from after sale services surpassing manufacturing returns. Also, while major airline affiliated MROs and their networks feel some pain from fleet reductions and airline failures, they continue to be profitable and are, in some regions, rapidly expanding.

So, what is the future of aviation MRO and is there a discernible trend away from independent MROs? What business models are accelerating within the industry; what are MRO Networks, how critical is it to be a part of one and what enabling technologies are currently required to drive growth, revenue, partnership collaboration and profits?

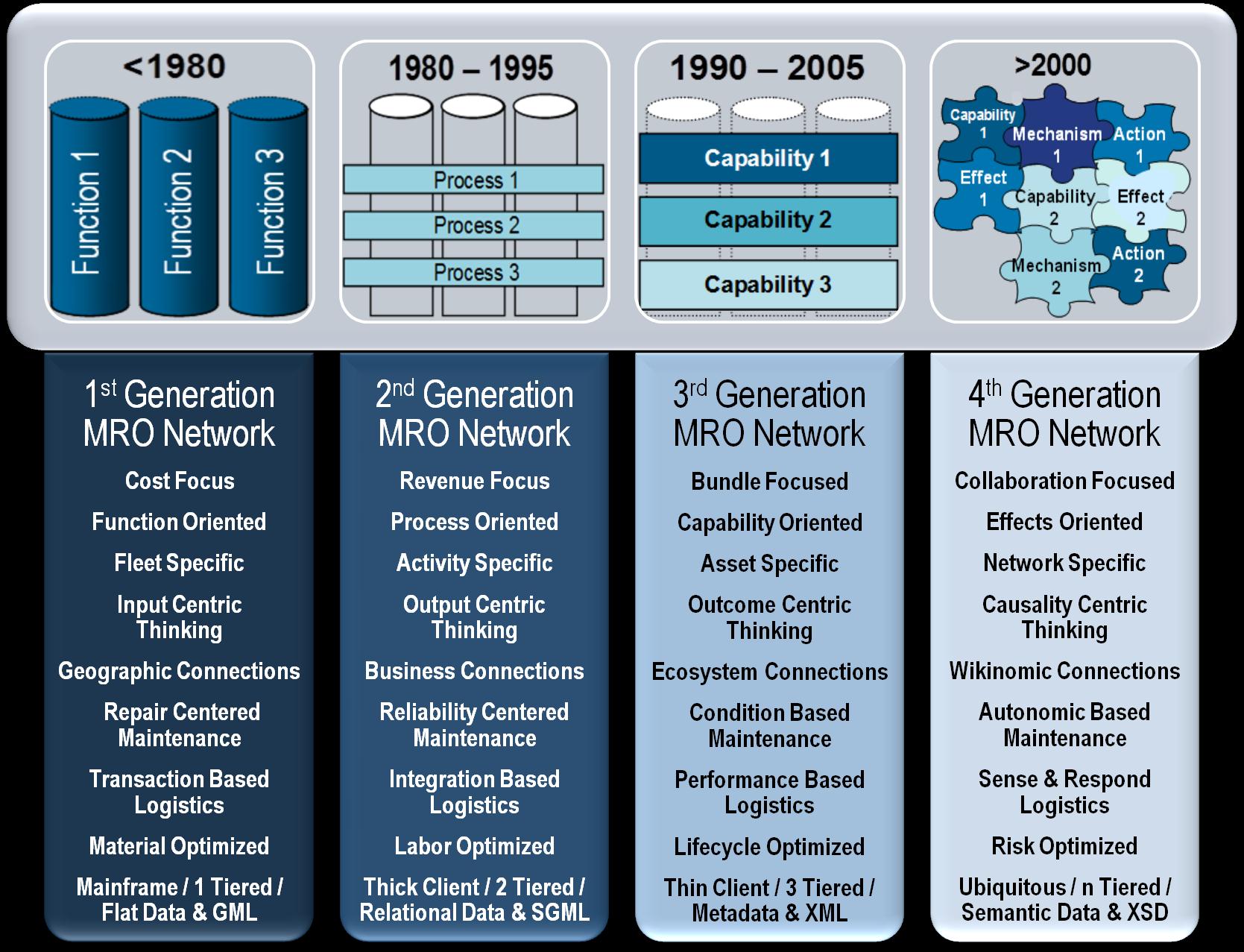

First Generation MRO Networks – Airframe Cost Collaboration

In the late 1960s, two consortia of European airlines created maintenance and supply chain collaboration groups. KSSU (KLM, Scandinavian SAS, Swissair and UTA) and ATLAS (Air France, Alitalia, Lufthansa, Iberia and Sabena) were not explicitly formed to conduct maintenance for profit but were collaborations focused on work allocation and cost sharing for the technical and economic management of, then new, Boeing 747 and Douglas DC10 aircraft.

Unlike their large US counterparts, European carriers didn’t then have the economies of scale to unilaterally support these new wide body aircraft. These first MRO networks were born from the need to share workload and create shared services ‘centers of excellence’. But what some at the time may have viewed as a disadvantage, in fact, created a skill in Europe that North American airlines and MROs didn’t develop until this decade and, even today, not to the same level of maturity… the capability to efficiently mass collaborate.

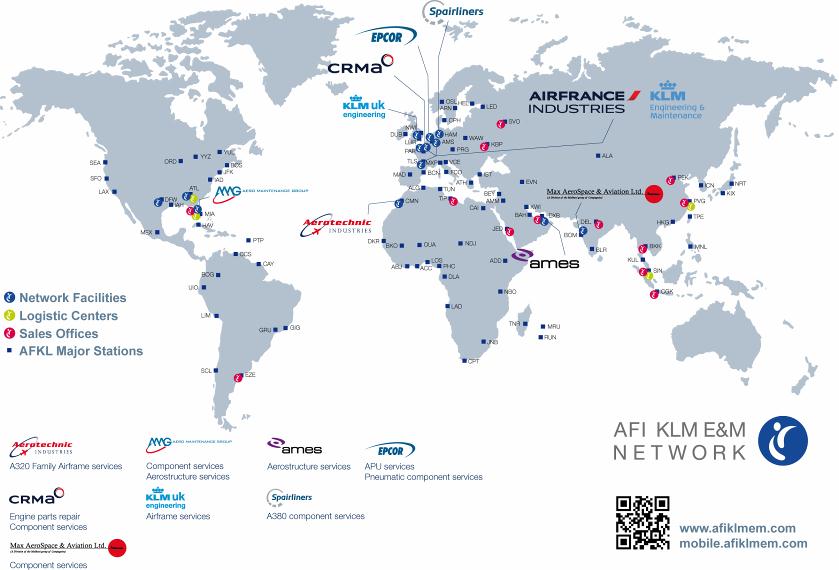

These first generation MRO Networks continue to this day in Lufthansa Technik LHT, Air France Industries / KLM E&M, TAM and SRT. In the case of first generation airline affiliated MRO Networks, the intent remains unchanged, to share certain workload with entities within the network to reduce costs.

Second Generation MRO Networks – MRO Profit Centers

The LHT Joint Venture network is considered by many to be the most advanced of this style business model. LHT cannot efficiently perform labor intensive work in-house so, by developing partnerships and joint ventures, it trades the LHT brand, outsourcing low margin, labor intensive work to less mature airlines and MROs and, in exchange, brings in high margin engine and component work. LH Group gets reduced maintenance cost for the airline and increased high margin maintenance revenue. Over time, LHT has developed several bundled services packages branded ‘Total (name of service) Services’: ‘Total Technical… ‘Total Engine… ‘Total Component… Services’. (See figures 1 and 2 for global reach of major MRO Networks).

Third Generation MRO Networks – Bundled Lifecycle Asset Management

The next generation of MRO networks was developed by engine OEMs. Identifying the trend of intermediation within the engine OEM market, Rolls-Royce developed ‘Power by the Hour’ (PBH), a bundled services market offering users a total lifecycle cost per flying hour (CPFH) business model.

By bundling financing with lifecycle sustainment of the asset, Rolls-Royce developed the ability to compete more effectively for engine sales and protect after-sale repair, service and parts revenue. It addressed the intermediation the engine OEMs were seeing by airframe OEMs, PMA vendors and large airline affiliated MROs. But to make this performance-based service lifecycle business model work, Rolls Royce and, eventually, all the engine OEMs, had to develop physical MRO networks with new IT capabilities such as in-service condition monitoring, diagnostics, prognostics and reliability analysis.

With a CPFH contract, the OEM finances the engine and ongoing maintenance with all the backend engineering and technical document management. The arrangement also blocks out non-OEM parts for the engines. However, prime vendors had to consider two options to make their MRO networks successful: either set up engine MRO shops around the world or enter into multiple OEM-MRO partnerships. In most cases, the partnership and joint venture approach won out.

So the third-generation MRO networks were started by engine OEMs changing their business model and added significant technology capabilities in the area of in-service condition monitoring, diagnostics, prognostics and asset health management; leading to increased asset reliability and availability at reduced lifecycle costs. For the engine OEMs, this part of their business now represents over fifty percent of revenues and eighty percent of profits.

The late 1990’s also saw the advent of the latest generation of networks based on airline MRO operations. For instance, the Swire group of Hong Kong which owns the majority of Cathay Pacific Airways and Hong Kong Dragon, operates Hong Kong Aircraft Engineering Company (HAECO), one of the largest aircraft engineering companies in Asia, and has assembled a network of MRO companies in China.

In the airframe market, this third wave of MRO networks are an airline affiliated full service evolution of the engine OEMs business model. What is new is the advent of sovereign fund backed MRO networks in the Middle East and Asia Pacific who are adding financing through sale lease back arrangements combined with airframe total solutions.

This network model is not unfamiliar to Asia Pacific businesses. Chaebol refers to a South Korean form of business conglomerate owning numerous international enterprises. The term is often used in a context similar to that of the English word ‘conglomerate’. In Japan, a keiretsu is a set of companies with interlocking business relationships and shareholdings; a type of business group. The keiretsu maintained dominance over the Japanese economy for the latter half of the twentieth century. Member companies own small portions of shares in each other’s companies, centered on a core bank; this system helps protect company managements from stock market fluctuations and takeover attempts, thus enabling long-term planning and investments in research, development and innovation. Today it is still a key element of the automotive and aerospace industries in Japan.

Evolving MRO network business models necessitated new information technologies

As large airline affiliated MRO networks and sovereign fund aviation networks have acquired airlines and MRO’s, a patchwork of dissimilar functional technologies have resulted in operational inefficiencies. OEM MRO networks are far more advanced with respect to data compliance and interoperability and may form the platform from which airlines and independent MRO networks build their intercompany solutions.

Where MRO networks that grew out of airlines are constrained by current capabilities and technology, OEMs had no such constraint and thus enjoyed the ability to start with a whiteboard when planning for the future of aviation maintenance. So, for example, Boeing’s GoldCare network has been able to perfect processes and technology in parallel to the development of new generation aircraft.

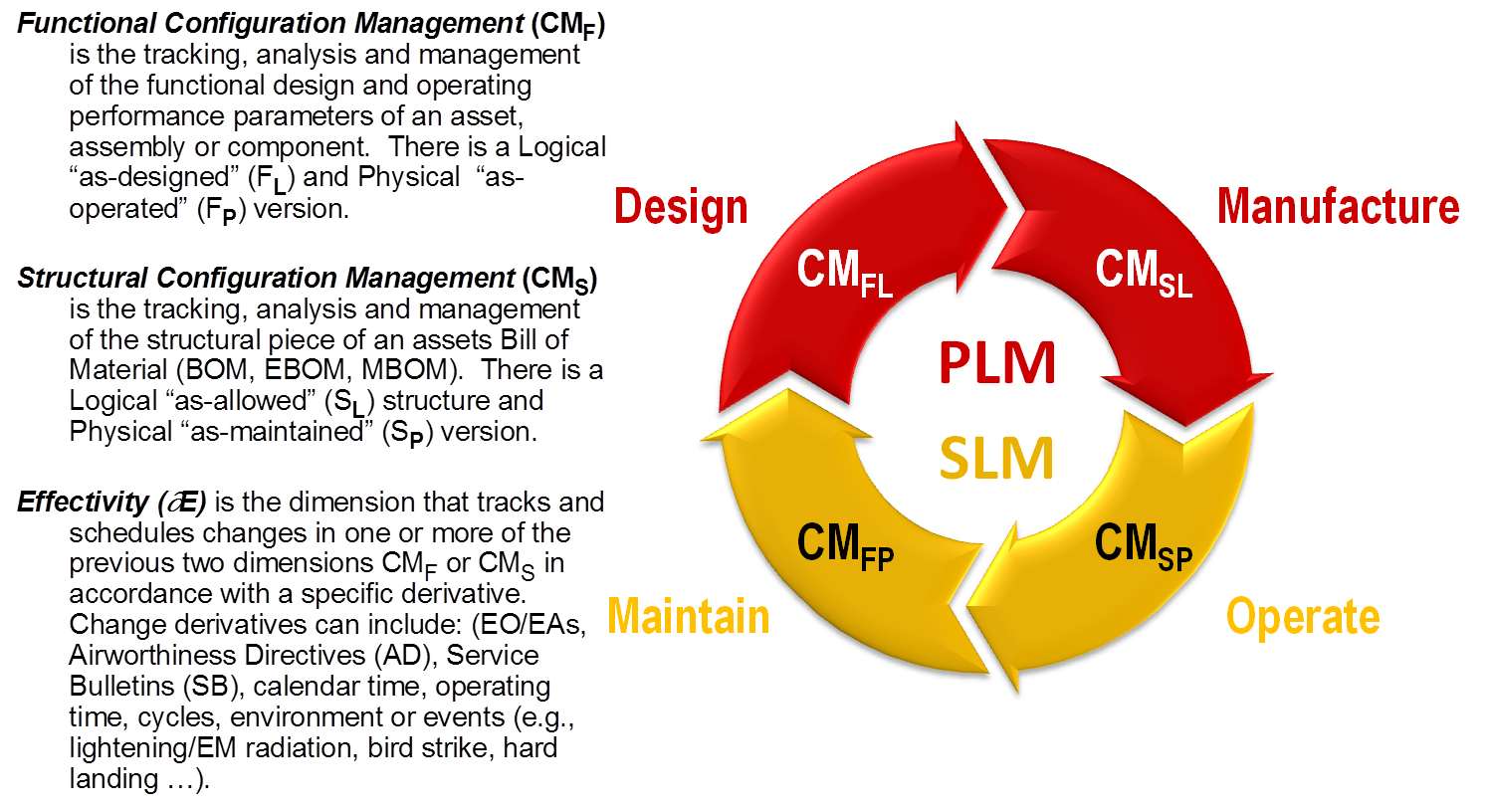

As OEMs increasingly enter the after-sale service market, it required them to develop capabilities not inherent in manufacturing. Product Lifecycle Management (PLM) is the manufacturer’s perspective and capability set which is considerably different from the operator and maintainer’s Service Lifecycle Management (SLM) capability set. The common thread enabling PLM and SLM is configuration management, which is also the core function of airworthiness.

The definition of airworthiness at its most basic level is ‘conformance to type certificate’ and ‘safe to operate’. The first is compliance to type design allowable structure and the second is compliance to type design allowable function. Sometimes we forget the basics of engineering such as what constitutes a part and part number. Again, at its most basic level a part number rolls when form, fit or function changes. Form and fit apply to structural configuration and function applies to functional specifications.

With this in mind, if you are in the product lifecycle business and, for whatever reason, decide to get into the service lifecycle business, you have no choice but to develop in-service monitoring, forecasting and maintenance capabilities.

RCM, CBM, and AHM (reliability centered maintenance, condition based maintenance, aircraft health management) are all advanced capabilities of configuration management across structural and functional dimensions.

Structural configuration management is the tracking and analysis of the structure of a component assembly and there are two dimensions to structural configuration; one being the logical, as to how the structure performs according to airworthiness; the other being the physical ‘as operated’ and ‘as maintained’ dimension of the structure.

Functional configuration management is the tracking and analysis of the functional design of the component assembly which also has both a logical ‘as designed’ and physical ‘as operated’ dimension.

What we are doing with reliability centered maintenance, condition based maintenance, diagnostics, prognostics, etc… all the advanced capabilities, is comparing and analyzing the logical to the physical – how these two things are matching up. The reliability of the maintenance program and the reliability of the engineered part as operated focuses on improving the physical functional configuration to match the ‘as designed’ logical functional configuration given a certain structural configuration.

If we operated assets in a vacuum or laboratory, in the exact same place and in the exact same way on every occasion, then this is all we would have to track; but we don’t. We operate aircraft in Europe, in deserts, in the tropics and in the Arctic. Some airlines operate aircraft from short take-off and landing airports, some from long; some airlines have longer stage links, some shorter; individual pilots will operate aircraft in slightly different ways. These differences affect the utilization, reliability and maintainability of components and assemblies in the aircraft in total.

Multi-dimensional is the ability to differentiate the structural and functional, the logical and physical across multiple effectiveness derivatives.

So manufacturers who have started getting into the service lifecycle management business have had to develop tools that, at their core, could manage the multiple dimensions of configuration in order that they can optimize their revenue by minimizing repairs, service parts and distribution across multi-echelon supply chains and repair networks; and this is becoming the key requirement differentiator for maintenance technology and the key enabler for advanced capabilities such as diagnostics, prognostics and autonomics.

Multi-Dimensional Configuration Management (MDCM) is a maintenance engineering capability that feeds Advanced Planning & Scheduling (APS) tools with requisite data. There are, in fact, multiple types of APS tools, such as ERP-based (Enterprise Resource Planning-based) capacity resource planning tools, MRO packaging & scheduling optimization tools, theory of Constraints-based finite capacity scheduling tools as well as transportation scheduling and routing tools. For clarity this article addresses service parts planning and allocation APS tools.

Readiness Based Sparing (RBS) is the military term for Service Parts Optimization (SPO) for performance based contracting – priced by the hour (PBH), performance based logistics (PBL) and cost per flying hour (CPFH) – and a set of tools using METRIC algorithms. Again, RBS or SPO is nothing new, the US Department of Defense (DoD) has been building algorithm based forecasting tools since the 1970s and they have been proven in the laboratory as one of the most accurate service parts forecasting and allocation technique for decades. In practice, however, RBS has not delivered the same results in real world use, primarily because the algorithms are extremely data sensitive – in terms of the established IT adage: ‘Garbage In/Garbage Out’. MDCM solves this problem by managing both functional and structural configuration of the physical asset across multiple fields of effectiveness. RBS and MDCM are not capabilities found in any ERP software and thus both capabilities require a composite best of breed (BoB) system or systems solution in order to optimally realize PBL and Service Lifecycle Management (SLM) financial and operational value improvements. Aviation SLM represents a potential stepwise function increase in productivity, maintenance, reliability, logistics effectiveness and total system cost efficiency.

Autonomic Logistics represents quantum advancement in the sustainment of aircraft. Under the PBL contract Lockheed has proposed for the multi-national F35 Joint Strike Fighter (JSF), service lifecycle costs are forecast to be reduced by 56%. But to attain this aircraft availability and lifecycle cost reduction, Lockheed has had to build an in-service performance monitoring capability which they call the Autonomic Logistics Information System (ALIS).

Delta aimed to cut its maintenance cost 51% or more using predictive analytics. In 2001, looking to reduce the $1 billion in spares inventory it carries, Delta Air Lines implemented Sevigistics Xelus inventory management application. Delta cut its maintenance spares expense by 11% in 2002 from $801 million to $711 million, saving $90 million. Delta also implemented SmartSignal condition monitoring and predictive maintenance tool to prevent costly engine failures altogether, weeks before they occur.

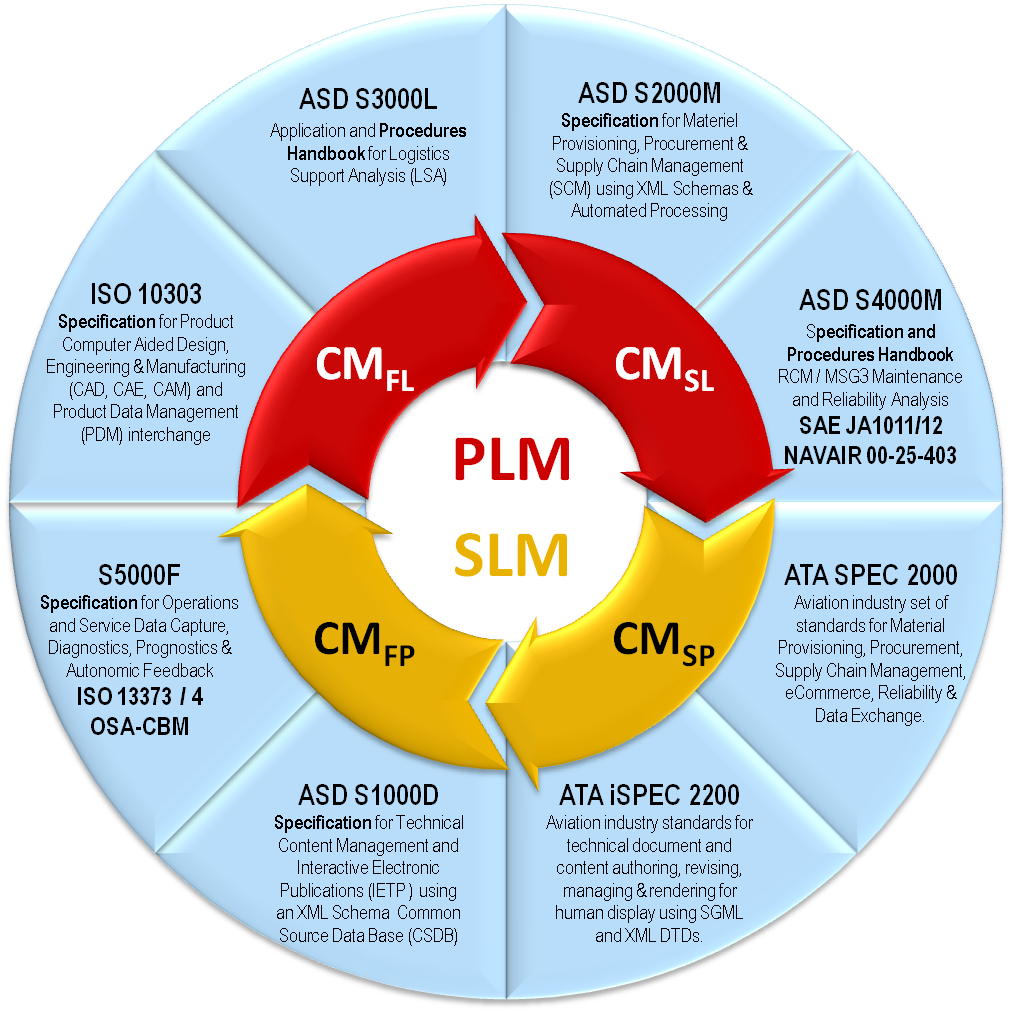

The problem with standards is everybody has one

Standards over the past several decades have grown up in different parts of the various aviation industries, aerospace, commercial air transport and the military. As such, the functions and processes generated different standards developed by different industry associations and governments. Given the memorandum of understanding (MOU) agreements between Airlines for America (A4A), Administrator for International Aviation (AIA) and the Aerospace & Defence Association of Europe (ASD) as well as the US DoD and NATO, the future appears to be set on select ISO 10303 and 13374 standards and the ASD SX000i family of standards.

Now, the challenge isn’t what to standardize on, it is when to incorporate those standards, the cost of conversion and senior management commitment to comply.

For new aircraft, the decision is easy. Backward compatibility for older aircraft is another story. Standards adoption is challenged by the duality of the value proposition of individual actors’ internal costs of compliance versus the ecosystem opportunity. Obviously, if any specific company didn’t have to individually bear the burden of conversion, adoption would be faster and relatively easy.

There are several industry trends that are accelerating standards adoption, namely; new generation aircraft, asset lifecycle management systems, increased regulatory oversight and the advent of new MRO network business models.

Regulatory pressures and opportunities support standards if regulatory bodies would simply be decisive and clear. The majority of regulatory enforcement action in maintenance is directly related to compliance to technical content and company procedures. Airlines and MROs both benefit from improved content standardization and interoperability.

On the other hand, regulators refusal to adequately define Instructions for Continued Airworthiness (ICA) exacerbate the challenge of airlines getting standards based data from OEMs and to provide configuration specific repair procedures to third party maintenance providers.

European Aviation Safety Agency’s (EASA) Notice of Proposed Amendment (NPA) for a Part M Subpart J independent Continuing Airworthiness Management Organisation (CAMO), is another driving force for data and content standardization as the new CAMO business model is predicated on efficiently managing multiple airworthiness programs, thus using dissimilar and mostly non-compliant airline technologies will no longer be an option. What works inside the four walls of an airline may not work across the ecosystem.

OEMs are a mixed bag of both helping and hurting industry data and content interoperability

New generation aircraft are a step change improvement in engineering and maintenance program planning and scheduling due to tightly integrated on-board and near-board condition monitoring, diagnostics, prognostics and aircraft health management. The value proposition is realized through increased aircraft availability via dynamic maintenance package phasing and autonomic logistics. OEM to airline to aircraft to MRO data networks only work with standardized data and content.

What’s also new is that content isn’t just for human consumption anymore. Traditionally technical document management is focused on human consumption of data – an engineer reading and writing a service bulletin generated EO (Engineering Order) or a mechanic reading a task card. Technology consumption of content is now the driving force for standards consolidation and modernization. S1000D is the core standard facilitating Integrated Electronic Technical Manuals, Central Maintenance Computers and off board AHM/PHM and maintenance information systems. The cost of data conversion is more than compensated by maintenance and supply chain savings, reliability and aircraft revenue generating availability.

While OEMs ‘eEnablement’ of aircraft lifecycle management is valuable, their pursuit of capturing larger pieces of the after sale services market and profits, are leading to what many would consider monopolistic actions. With respect to data, OEMs are using control of technical intellectual property (IP) via access to technical manuals and repair procedures as well as the form of such content – pdf versus Air Transport Association (ATA) or ASD compliant XML.

It behooves airlines to look outside the four walls of their company to the entire ecosystem within which they actually function.

Leasing companies may be best positioned to enforce standards.

The Aviation Working Group commissioned Seabury Aviation to conduct a study on the economic impact assessment of dissimilar technical regulatory requirements impacting cross-border transfer of aircraft. This study estimated that the dissimilar regulatory requirements and content-data harmonization resulted in $7 billion of cost to the leasing industry over the past 20 years. Direct costs accounted for $5 billion or 68.5% and aircraft downtime losses accounted for $2.3 billion or 31.5%. The study further identified that 93% of these costs were not material safety discrepancies; rather, 58% had similar intended safety objectives, 20% were duplication and 15% were non-safety related. At the same time the IATA maintenance cost task force is working on standardizing aircraft and engine lease contracts and maintenance reserves. Lease contracts and maintenance reserves are getting even more complex and nonstandard as new generation aircraft come with maintenance programs that can be dynamically packaged and phased. Dynamic packaging is great for aircraft operational availability but is causing challenges for lessors in forecasting and managing maintenance reserves.

But it is lessors that are in a unique position to enforce data harmonization through their contracting mechanisms. Lessors can easily add data and content standards to aircraft and engine leases and component sell/lease-back contracts. In doing so, they can feed their own asset management and compliance tools, as well as enforce aviation industry standards.

And that brings us back to the organizations with the greatest motivation to adopt new interoperability standards; bank and sovereign funded MRO Networks who also perform asset leasing. They benefit at the front end by multiple customer integration and at the back end by improving B2B efficiency.

The promise of MRO Networks benefits everyone in the aviation ecosystem

The ability to travel from one country to another and use a credit card, ATM card, cell phone, iPad or laptop WiFi is simple and seamless.

The ability to move an aircraft from one regulatory geography to another and the ability to transfer aircraft records, tech manuals, task cards or MPD from one company to another somehow requires the use of paper or pdf and back flips by IT departments. COOs and business units should be incensed, as should CFOs.

The vision of the promised land of seamless MRO B2B interoperability between OEMs’ products and airlines’ services across the various MRO Networks has been on the drawing board for well over a decade. We have made significant progress through the influence and edicts of the US DoD and NATO mandating certain ASD standards and the technological advancements of new aircraft systems.

MRO business networks need industry standard MRO IT networks. The problem isn’t that the technology and standards haven’t been developed that provide considerable operational and financial benefits to all of the participants in the ecosystem. Rather, the challenge we face today is one of execution and collaboration.

Business models and technology have evolved to the point that traditional methods simply can no longer keep up. And while the costs of not implementing new standards based technology today may pale in comparison to more pressing issues such as fuel and labour costs, the failure to act slowly and steadily erodes the infrastructure that makes the entire ecosystem and individual businesses run.

The challenge is also one of visibility for senior executives that haven’t been presented with the value potential. Why buy smart aircraft and plug them into a dumb maintenance management system? It’s just one more death by a thousand cuts.

At the end of the day, the consequences of inaction get passed along to aircraft owners and operators and ultimately to their end consumers – passengers.

Comments (0)

There are currently no comments about this article.

To post a comment, please login or subscribe.