Articles

| Name | Author | |

|---|---|---|

| Case Study: Jazz Aviation – Paperless Maintenance Processes | John Hensel, Manager of Business Systems Integration and Development, Jazz Aviation | View article |

| How I see IT Using Blockchain to reinforce aviation asset management | Bas de Vos, Director of IFS Labs, IFS | View article |

| Strategic Supplier Contract Management | Saravanan Rajarajan, Associate Director – Aviation Implementation, Ramco | View article |

| Case Study: AirTanker: an MRO/M&E software implementation | Ian Thatcher, Engineering Manager, AirTanker Services Ltd. and Ian Kent, Aviation Consultant, Rusada | View article |

Strategic Supplier Contract Management

Author: Saravanan Rajarajan, Associate Director – Aviation Implementation, Ramco

SubscribeStrategic Supplier Contract Management

Saravanan Rajarajan , Associate Director – Aviation Implementation at Ramco plots a path to smarter business operations based on clearer contracts

Airlines are moving heavily towards outsourcing as one of their key strategies for cost control. Most or all of the Maintenance & Engineering functions including Base, Engine, Shop and even Line maintenance are being outsourced. Airlines are also increasingly using pay-by-the-hour total part support programs for their entire supply chain management (SCM).

The key rationale for outsourcing, i.e. balancing the agreed service level for the given pricing and calculated business operations risk, largely depends on the way the contract is initially laid out and how well its performance is monitored over its contractual period. Complexity of contracts becomes ever more intricate as Airlines act on their preference for a single stop service provider to meet all of their outsourcing requirements: that might include Base, Shop and Line maintenance services along with CAMO and a pay-by-the-hour parts support program.

The question is, do Airlines manage these contracts efficiently to protect their business interests and, at the same time, encourage the supplier to deliver its best performance?

SUPPLIER CONTRACTS: VALUE LEVERS

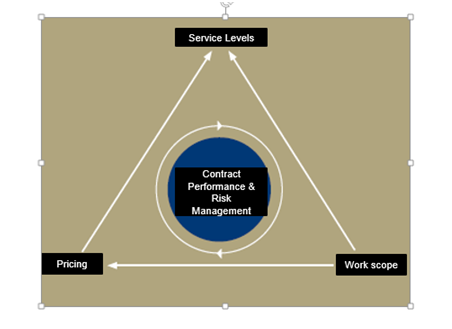

Supplier contracts are driven basically by three value levers: work scope, pricing and service levels (figure 1). Contracts are usually detailed and comprehensive on the work scope and pricing levers; whereas the service levels clarity is very often a difficult problem to handle at both the contractual level and operational stage. Defining the right KPIs (key performance indicators) in relation to the services, associated service levels and measurement methodology have to be agreed between airline and supplier so that, should any issue arise during the contract period, they’ll both be referring to the same levels of expectation.

Figure 1 Contract Value Levers

STRATEGIC SUPPLIER CONTRACTS

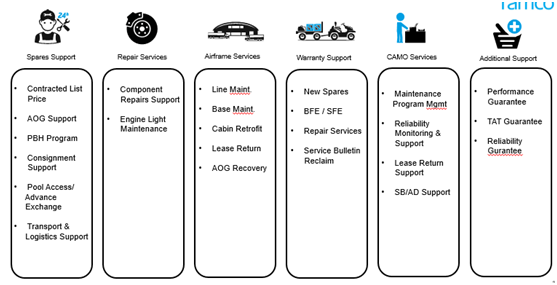

With OEMs and Large MROs expanding their services portfolios to encompass all the M&E and SCM requirements of Airlines (figure 2), it provides an opportunity for an airline to get into a strategic contract for all or most of its needs. For multiservice strategic contracts in addition to work scope and pricing the following factors warrant the utmost clarity.

- Penalties and Incentives: Based on the KPI’s agreed, the penalties and incentives associated with the KPI’s have to be clearly defined. The calculation formula, supporting documentary evidence required from both parties, the frequency of assessment, transparency of the information and exclusion clauses to be included in the contract.

- Invoicing: Clear definition of ‘in scope’ and ‘out of scope’ activities and items, along with pricing is a prerequisite for invoicing from the supplier and verification by the airline. However some additional guidelines on the requirements for the supporting documents – Tax and Duties, Offsetting Penalties and Incentives, Frequency of Invoicing – should be included in the contract.

- Performance Review: Agreed review mechanisms should be established between the supplier and the airline on reviews of the contract performance against agreed scope, frequency of reviews, joint risk and issue assessment.

Fig: 2 Strategic Supplier Contract

SPARES SUPPORT:

A basic spares support program can start with the contracted list price for the parts with an agreed lead time. However the scope of spares support has increased to cover exchanges, loans, pool access, etc. The evolving trend towards ITM (inventory technical management) extends spares support to include repair, float management and CAMO services for repairable and rotable units.

When structuring the service levels for spares support, the following KPIs need to be agreed with clarity and with associated penalties and incentives:

- Delivery guarantee: Supplier takes the responsibilities for the entire transport and logistics process until the part is delivered (an accepted handover point should be specified and agreed in the contract) to the airline. Normally applicable for unscheduled events.

- Dispatch guarantee: Supplier takes the responsibilities for availability, may get shipped later or available for pick up by the airline. Normally applicable for scheduled events.

- Consignment stock fill rate: Supplier takes responsibilities for availability of items at the airline base for use at any time. Normally applicable for No Go/MEL/ETOPS and long lead time items.

- Core late return fee: A fee associated with the late return (as agreed in contract) of the core units from the airline to the supplier.

- Reject or quarantine rate: Items failed or quarantined under quality inspection during receipt and time taken to solve the issue.

Repair Services:

The repair services contract can span from standard fixed price for part services to pay-by-the-hour. As the repair scope of the items largely depends on the findings it is imperative that the contact is laid out with proper in scope and out of scope events. Clarity on work scope and pricing on modifications, BER (beyond economical repair), NFF (no fault found) and Obsolesce, are key for the effective management of repair contracts. When structuring the service levels for the repair services, the following KPI must be agreed with clarity and with associated penalties and incentives.

- Guaranteed delivery TAT (turnaround time): Supplier takes responsibility for the entire Transport and logistics until it is delivered (an accepted handover point should be specified and agreed in the contract) to airline after repair.

- Guaranteed dispatch TAT: Supplier takes the responsibility for shipping from his facility or for pick up by the airline. Transport and logistics responsibility shall be with the airline.

- Reject or quarantine rate: Items failed or quarantined under quality inspection during receipt and time taken to solve the issue.

- No fault found (NFF): Clear definition and tracking of Percentage of NFF from contract and financial perspective.

- Beyond economic repair (BER): Clear definition and tracking of percentage of BER from contract and financial perspective.

- Out of scope repair: Scope of repair carried out as out of scope with classification – FOD (foreign object damage), Misuse.

Airframe Services:

The possible scope of Airframe maintenance is large, spanning across Line Maintenance, Base maintenance, Cabin Retrofit, Lease return, Repainting, etc. and this poses a greater challenge in defining what is in scope and what is out of scope. Once the scope is established and agreed, the rate structure for both in scope and out of scope are equally important due to Slab based pricing , Caps on Materials and Labor and yearly escalation .When structuring the service levels for the Airframe Services, the following KPI to be agreed with clarity with associated Penalties and Incentives.

- Turnaround reliability: Supplier takes responsibilities for TAT for major checks with clear definitions of TAT exclusion clauses under control with Supplier. Ex; Waiting for Airline Approval on additional work scope; Reliability of the turn time over the period involving multiple checks.

- Technical dispatch reliability: Applicable for Line Maintenance, reliability of the supplier to release aircraft on time.

- Defect leakage: Defect In / Defect Out ratio and where the defects were deferred with the reasons – in control of the supplier or out of their control.

- Work package completion: Percentage of planned tasks deferred with reasons in control of the supplier or out of their control.

- Overtime cost: Overtime cost Percentage in proportion to overall labor cost.

Warranty Support:

The ability of the Airlines to recover the warranty largely depends on the process and systems it adopts which brings out all the potential warranty claimable events. The prerequisite for this is establishing a firm contract with the supplier on various warranty clauses and setting up a monitoring mechanism.

Setting up of the warranty contract should consider the various different clauses applicable for new part purchase, repair services, BFE (buyer furnished equipment)/SFE (supplier furnished equipment) items, SB (Service Bulletin) based warranty etc. The criteria for warranty whether it is tracked by Flight Hours or flight Cycle or calendar based, agreed labor rates for SB based warranty reclaim should be monitored over the period of contract.

Documentation requirement from airline to support the claim, minimum filing period and failed part disposition rules must be set in advance.

- Warranty claim Ratio: Amount claimed successfully with respect to the total claim requested.

CAMO Support

CAMO support can extend from customizing the maintenance program management over the MPD (maintenance planning document), forecasting the scheduled occurence of maintenance events and the plan for work completion. This also encompasses the SB/AD (Airworthiness Directive) management and compliance and reporting. Engineering advice required to support maintenance is also expected.

- Engineering advice response times: Supplier takes responsibility for providing the engineering advice within the agreed time.

- Maintenance hours: Ratio of MPD maintenance hours , to customized program maintenance hours vs actual maintenance hours.

- Reliability improvement: Proven improvement on the component / system reliability which has resulted in the improved MTBUR (Mean time between unscheduled removals).

- Maintenance cost / FH or BH: Proven improvement on the maintenance cost over flight hours or block Hours

Additional Support:

In addition to the warranty support, suppliers provide the Performance Guarantee for the parts and services. The key to a claim guarantee is clear definition of contract and ability to process high amounts of data, and discern the supporting information for the claim.

- Material cost guarantee: Material cost if exceeded the guarantee objective rate $ / FH (flying hours) over the cumulative guarantee period, then the supplier is liable to pay based on the agreed rates.

- Maintenance cost guarantee: Maintenance cost, if it exceeded the guarantee objective rate $ / FH over the cumulative guarantee period then the supplier is liable to pay based on the agreed rates.

- TAT guarantee: if the Actual TAT for purchase, repairs, Base checks, etc. exceeds the contracted value, the supplier is liable to pay a penalty.

- Reliability guarantee: If MTBUR or the agreed measure of component reliability exceeds the contracted values, then supplier is liable to compensate.

Integrated Contract Performance Management

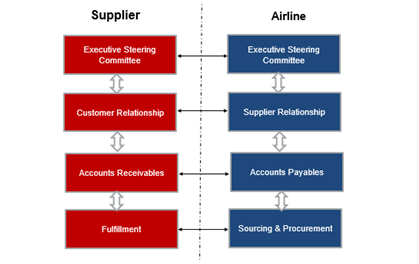

The mutual dependency and performance of the contracts largely depends on the organizational structure supporting the contract from both sides on operational and strategic levels (figure 3).

Figure 3 Integrated organizational structure

At the Operational level, airlines SCM and M&E departments will interact with the suppliers to place orders and receive services or parts. Key responsibilities also include monitoring the KPI laid out for the services and highlighting any risk or issues which might affect the same. Airlines Accounts Payables has to interact with the Supplier Accounts Receivables department to manage the payments, penalties, incentives arising out of the services provided and KPI results.

Creating Customer Relationship and Supplier Relationship entities can be challenging on both sides due to the deeper skill sets required. These two entities must be closely integrated to share data and track the contract performance on an holistic basis across all lines of services on a continuous basis.

The role of Executive Steering Committee is key for strategic alignment in ensuring the business objectives are met, fostering collaboration across various functions between the airline and the supplier organization, providing guidance and taking course corrections on the risk and issues facing the contract performance.

From Dashboard to Flight Deck

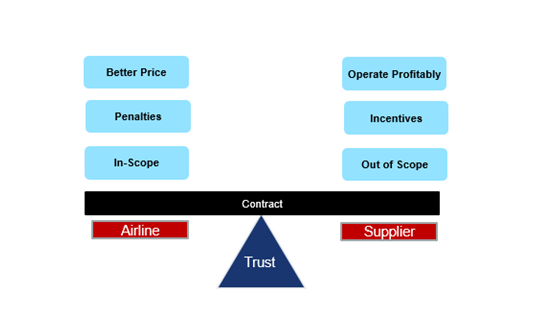

With Airlines outsourcing most of their M&E and SCM requirements to the suppliers, getting into a balanced framework of contract between the airline and supplier will be the key sustainment (figure 4). Contracts established with clear definitions of work scope, pricing, the right KPI’s, penalties and incentives and more importantly organizational structure from both sides to support will pave the way for long-term success.

Figure 4 Win –Win Partnership

As airlines and suppliers align their business objectives and work towards a ‘win-win’ partnership, the need for mutual trust has never been more critical than now.

Contributor’s Details

Saravanan Rajarajan

Saravanan Rajarajan is an Associate Director for Aviation Implementations and Subject Matter Expert in the area of Aviation Supply Chain. He has rich domain expertise and diverse implementations experience of rolling out Ramco M&E Solution in Airlines, Rotor Wing Operators and MRO organizations globally, over the past 13 years. He holds Bachelor’s degree in Mechanical Engineering and Masters in Business Administration. He also possesses CPIM certification from APICS.

Saravanan Rajarajan is an Associate Director for Aviation Implementations and Subject Matter Expert in the area of Aviation Supply Chain. He has rich domain expertise and diverse implementations experience of rolling out Ramco M&E Solution in Airlines, Rotor Wing Operators and MRO organizations globally, over the past 13 years. He holds Bachelor’s degree in Mechanical Engineering and Masters in Business Administration. He also possesses CPIM certification from APICS. Designed to be accessible on cloud and mobile, Ramco Aviation Software continues to add technological innovations with ‘Anywhere Apps’, redefining the power of Mobility, to significantly reduce transaction time both during AOG conditions and critical aircraft turnarounds. The software helps aviation companies ensure zero tolerance to error, with higher safety standards. To know how Ramco Aviation Suite can create business value to your organization, reach out to contact@ramco.com

Designed to be accessible on cloud and mobile, Ramco Aviation Software continues to add technological innovations with ‘Anywhere Apps’, redefining the power of Mobility, to significantly reduce transaction time both during AOG conditions and critical aircraft turnarounds. The software helps aviation companies ensure zero tolerance to error, with higher safety standards. To know how Ramco Aviation Suite can create business value to your organization, reach out to contact@ramco.comComments (0)

There are currently no comments about this article.

To post a comment, please login or subscribe.