Articles

| Name | Author |

|---|

The Connected Aircraft: Future Possibilities

Author: Joshua Ng, director and expert on Airline Apps and Connectivity, and Alan Lim from Alton Aviation Consultancy

SubscribeJoshua Ng and Alan Lim from Alton Aviation Consultancy explore the ‘connectivity revolution’ for airlines and their passengers, and how recent innovations in the space and satellite technology sector are driving down the costs of inflight connectivity.

On the ground, we are witnessing the democratization of connectivity. Smartphones have become ubiquitous, and fast 4G/5G data is available for a fraction of what data transfer at slower transmission speeds cost 10 years ago. Many in developing nations have jumped straight to mobile – bypassing the telephone and computer altogether.

The same cannot be said for connectivity onboard passenger aircraft. Aircraft connectivity has been expensive, slow, and intermittent – a trifecta of issues that limits the widespread usage by air travelers and air crews. However, we are seeing the beginnings of a connectivity revolution that will open the envelope of opportunities for both passengers and airlines alike.

CONNECTIVITY BANDWIDTH IS INCREASING, DRIVING DOWN CONNECTIVITY COSTS

Recent innovations and huge amounts of Research & Development (R&D) in the space and satellite technology sector is driving down the costs of inflight connectivity. The cost of satellite launches has declined substantially in recent times, from US$18,500 per kg (NASA data) to slightly under $3,000 per kg based on the recent launch cost for SpaceX rockets

In addition, smaller satellite form factors, with weight reductions of over 50%, allow more satellites to be lofted in a single mission and improved antenna technology not only drives weight reductions, but also increases the satellite bandwidth throughput.

According to various reports, the total sellable satellite bandwidth capacity is expected to grow from 2.2 Terabytes per second (Tbps) in 2019 to 25 – 40 Tbps in 2025. New and existing satellite providers have plans to add satellite capacity over the next 10 years, as shown in the table below.

Exhibit 1. Selected Satellite Providers (non-exhaustive list)

| Provider | Service | Technology | Future Plans |

| Inmarsat | SwiftBroadband GX (Global Express) EAN | L-band Ka-band S-band + ATG | GX plans to launch 7 additional satellites in 2022 and beyond |

| Viasat | Viasat | Ku-band Ka-band | ViaSat-3 is a 3 satellite geo-stationary constellation expected to launch in 2022 |

| Iridium | Iridium NEXT | L-band and Ka-Band | 66 satellite constellation in low-Earth orbit launched between 2017 and 2019 No plans for additional satellite launches |

| OneWeb | OneWeb | Ku-band and Ka-band | Entered bankruptcy in 2020, and exited bankruptcy with investment from UK Government and Bharti Global in the same year Deploying a constellation of 650 satellites in low Earth orbit (LEO) with limited-service launch in 2020 and broader service available in 2021 |

| SpaceX | Starlink | Ku-band, Ka-b and and V-band | 4,425 satellite Ku/Ka-band constellation and 7,500 V-band constellation, with plans for another 30,000 satellites 1,400 satellites launched to-date |

| Amazon | Kuiper System | Ka-band | Received approvals in 2020 for 3,200 satellites in low-Earth orbit Half of the constellation expected to be deployed by 2026, with full constellation in orbit by 2030 |

HOW WE WANT TO TRAVEL IS CHANGING

According to an eMarketer survey, we are spending more of our waking hours connected with others. Connected time has more than doubled over the last 10 years, to nearly eight hours per day in 2020. As we stay connected for longer, it is no wonder that the same consumers are demanding aircraft connectivity. According to an Inmarsat survey, 66% of survey participants feel that Wi-Fi is fundamental to daily life and believe that inflight Wi-Fi is an absolute necessity. Two-thirds of passengers would also be more likely to rebook with an airline if quality inflight Wi-Fi were available.

In response to consumer needs, many airlines have made plans for fleet-wide free onboard Wi-Fi (Delta Air Lines, JetBlue Airways) or fleet-wide paid Wi-Fi (Singapore Airlines, Qatar Airways) as part of their value proposition to ensure that customers will soon never need to be disconnected while travelling.

COVID-19 HAS ACCELERATED THE CONNECTIVITY TRANSFORMATION

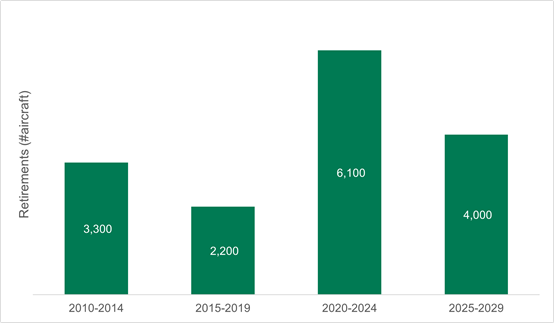

The COVID-19 pandemic brought unprecedented change to the aviation industry. One of the results from the crisis is the expected retirements of a significant percentage of the current fleet. Many aircraft were parked or stored at the start of the pandemic in 2020, and we expect models that are less fuel-efficient like the A380s and A340s, as well as a number of older aircraft, to stay parked even as the recovery gets underway. Our Alton analysis forecasts 6,100 aircraft retirements between 2020 – 2024 (figure 1).

Aircraft retirements, historical and forecast

Prior to COVID-19, approximately a third of the global fleet had connectivity systems installed, with reluctance from a wide spectrum of carriers that had not been able to substantiate the return on investment.

For health and safety reasons, COVID-19 has accelerated various digital trends. Passengers are demanding more self-service travel options, leveraging their own devices to interact at the airport during check-in, and to stream content while in-flight. While not necessarily as a means to deliver Wi-Fi-connectivity inflight, connectivity systems also open up an aircraft-wide communications network onboard, allowing hosted airline applications (services, content) to be delivered to the passenger’s own device, without needing to touch common use equipment such as Inflight Entertainment (IFE) systems, or speak with flight crew members.

Through the crisis, our sources have indicated that airlines continue to install connectivity systems on new production aircraft despite the additional costs; in the retrofit market, airlines have not cancelled their connectivity systems, but merely delayed the modifications until the aircraft comes out of storage or requires an airframe check.

WHAT IS AT STAKE? PASSENGER-FACING USE CASES

What a passenger does onboard the aircraft will likely stay the same; but the interaction medium will change and that might have wider implications off the aircraft.

- Passengers will still consume media content onboard. Once provided as part of the IFE system, passengers will now be able to select not only the airline’s curated IFE content, but also a wide range of media from their favorite streaming sites as well as from general internet browsing. Connectivity will also allow passengers to connect with their loved ones, colleagues and others through social media, emails and other online platforms.

- Passenger Personal Electronic Devices (PEDs) will complement seatback IFE systems. From a passenger’s perspective, consuming media all through a single device has its benefits, and in the age of COVID-19 avoids the need to touch common-use IFE systems. From an airline’s perspective, the airlines will increasingly shift their investments towards internally-developed platforms and systems within the airline app, creating feature-rich options that would likely surpass what an IFE system can do.

- The airline app will be the center of airline – passenger interactions. A digital-first application ecosystem will not only support onboard use cases such as Wi-Fi connectivity access, digital media streaming and meal ordering, but travel journey-related use cases such as flight bookings, check-in, customer support and other touchpoints.

- The airline app can do more than manage the travel journey. Airlines have a loyal and international customer base that can be further monetized across non-travel related retail spend.

AIRLINE OPERATIONS USE CASES

Airline operations can also benefit from the increasingly available connectivity in the following ways.

- Flight path optimization and fuel efficiency. One of the key benefits of increased connectivity concerns flight path optimization. While at various levels of technology readiness, flight planning systems can now incorporate a lot more data from the aircraft, including aircraft-related performance as well as weather data, to optimize their flight paths, reduce fuel consumption and avoid costs. Some flight planning software algorithms are promoting savings of a few percentage points, with higher savings benefits available for long-haul flights.

- ACARS over IP (AoIP). Aircraft Communications Addressing and Reporting System (ACARS) messages are largely transmitted over VHF and HF spectrums and with greater connectivity there is potential to move some of those messages onto IP-based ACARS protocols ACARS Over IP (AoIP). Airlines are generally paying hundreds of dollars per month per aircraft in ACARS costs today, and with AoIP this cost can be substantially reduced, or data transmission can be increased with minimal cost. This evolution in the traditional ACARS operating model will likely be similar to the text message, where pricing has been reduced significantly in the wake of WhatsApp / WeChat and other IP-based text messaging systems, but its relevance has not diminished with new use cases taking advantage of the existing network.

- Flight tracking and Global Aeronautical Distress and Safety System (GADSS) compliance. The Air France flight 447 and Malaysia Airlines flight 370 incidents both highlighted the need for continuous monitoring of aircraft flight positioning, to alert airline operation centers when aircraft are in distress. Connectivity systems can provide a means of GADSS compliance and provide an alternative to deployable Flight Data Recorders (FDRs), by squawking aircraft positional data while inflight.

- Predictive aircraft maintenance. A broader range of aircraft data can also be transmitted in real-time to provide an accurate digital picture of the health of the aircraft and its systems. Flight cancellations caused by aircraft technical issues can cost airlines tens to hundreds of thousands of dollars in compensation payments, accommodation and travel incidentals. The ability to reliably predict when aircraft systems will fail, and have remediation solutions in place to prevent delays or cancellations can help improve schedule reliability and customer satisfaction.

- In-flight verification of POS data. SITA estimates that 5 -7% of inflight sales are fraudulent, due to the delayed verification of Point of Sale (POS) credit card data. Connectivity will allow for real-time credit card transaction processing, driving up airline ancillary profit margins, and potentially opening up in-flight retailing to high-dollar value products that are largely restricted due to risk of fraudulent sales.

IN CONCLUSION

COVID-19 has made the global citizenry more digitally plugged-in, and likely to demand more services through their mobile phones and via the internet. As travel demand picks up, airlines that have positioned themselves to support this trend may have additional value propositions to the would-be passenger, aside from the price competitiveness of the airfare. Connectivity also has benefits for airline operations, further enhancing the business case for connectivity systems installations by reducing the payback period.

Ends…

Contents

Connectivity has long been discussed by airlines but the impact of a pandemic and the perennial need to deliver more services for less cost in a passenger-friendly manner makes getting the best connectivity a business-critical objective.

Contributor’s Details

Joshua Ng

Joshua Ng brings nearly a decade of experience in the aviation and aerospace industry with significant expertise in business strategy development, market demand forecasting, supply chain management, operational performance improvement, and financial modelling. Prior to joining Alton, Joshua began his career at ST Aerospace and later joined the New York-based consulting team of ICF, where he was a key member in the aviation & aerospace practice. Joshua earned his BS in Mechanical Engineering from Cornell University and his Masters of Engineering in Logistics from MIT.

Alan Lim

Alan Lim is a seasoned aviation professional with almost a decade of management consulting and line management experience. He started his career with Singapore Airlines and was one of the pioneer members of the airline’s Business Transformation team, where he helped to kickstart its three-year long transformation program. Prior to Alton, Alan was a management consultant with Partners in Performance, an implementation-focused consultancy. He earned his BS in Economics from University College London and his Master of Science in Financial and Managerial Economics from HEC Paris.

Alton Aviation Consultancy

Alton Aviation Consultancy is a specialist advisory firm dedicated to serving the aviation and aerospace industries. Clients trust the Alton team to deliver the objective, data-driven guidance and insight required to inform their business strategies, allocate capital, prioritize resources, and manage risk. Alton works with clients on engagements that span the aviation and aerospace value chain to include commercial, financial and technical aspects. Clients include airlines, manufacturers, MRO and aftermarket service providers, airports, lessors, and the broader financial and investment community.

Comments (0)

There are currently no comments about this article.

To post a comment, please login or subscribe.