Articles

| Name | Author | |

|---|---|---|

| Case Study: PIC – Pilot in Command or Processor in Command? | Ping na Thalang, Vice President Information Systems Dept, Bangkok Airways | View article |

| White Paper: Business Intelligence – More than information alone | Gesine Varfis, Managing Consultant, Lufthansa Consulting | View article |

| White Paper: Fuel Efficiency through IT Support | Captain Marcel Martineau, President and CEO, TFM Aviation Inc. | View article |

| White Paper: Designing the Enterprise Solution | Lawrence A. ‘Bud’ Sittig and James R. Becker, Flight Guidance LLC | View article |

| Case Study: EFB – Posing Questions and Offering Answers | John Christian Paulshus, Head of Business Development Operational IT Solutions, Norwegian | View article |

White Paper: Business Intelligence – More than information alone

Author: Gesine Varfis, Managing Consultant, Lufthansa Consulting

SubscribeBusiness Intelligence – More than information alone

Smarten up your operations with real-time business intelligence for inter-operative collaborative decision making, says Gesine Varfis, Managing Consultant, Lufthansa Consulting

The end of operative reporting as we know it?

Neither mention of IATA delay codes, nor the discussion of delay reports are likely to raise a cheer among airline personnel: the same could be said for other ‘operations and maintenance’ key performance indicators (KPIs). Indeed, some people may become stressed when simply thinking about delay codes: they relate delays with exhaustive operations delay review meetings, where cause after cause of delays have been discussed. Others might relate them to massive amounts of paperwork, Excel spread sheets or Power Point presentations to be prepared on a daily, weekly and monthly basis.

Nevertheless, while delay codes and reports may well be unexciting, the operative challenges that they flag up are about reducing delays: and delays cost money – about €3.500 – €4.000 per hour’s (1) delay – plus, as importantly,delays cost reputations and can lose customers.

Airlines have implemented a range of IT solutions to assist in the management of irregularities or delays: for some airlines there will be as many as 200 to 400+ operations related applications. Today’s IT solutions focus on the reduction of complexity to allow fast collaborative decisions. Operative solutions focus on real-time operations management, interfaced and integrated as well as complemented by state-of-the-art planning systems. Although IT systems are key elements in the improvement of performance, they are only a part of what is needed to ensure operational excellence. Today’s state-of-the-art operations are about balancing and, at the same time, optimizing operative standards, processes, the organization, culture and infrastructure. However good these operations applications are, their business intelligence value is limited. Moreover, delays are still reported and measured in static reports either generated via individual systems, or manually gathered and recorded. This leaves airlines with a lot of information in different data marts. Worse still, some of the data available cannot even be gathered via standard reports and therefore cannot be used.

Today’s IT focus is on hosting legacy systems, the IT landscape and architecture. Many organizations still expend a lot of time and effort optimizing their current operations IT landscape. But the real question is, what should be adapted: operations to the tools, or are the tools customized to meet the business specifics? Above all it is about return on investment (ROI), interfacing, automation and migration plans. Due to their complexity these migration plans require a lot of effort, sometimes up to a year of planning, to manage upgrades or an exchange of systems.

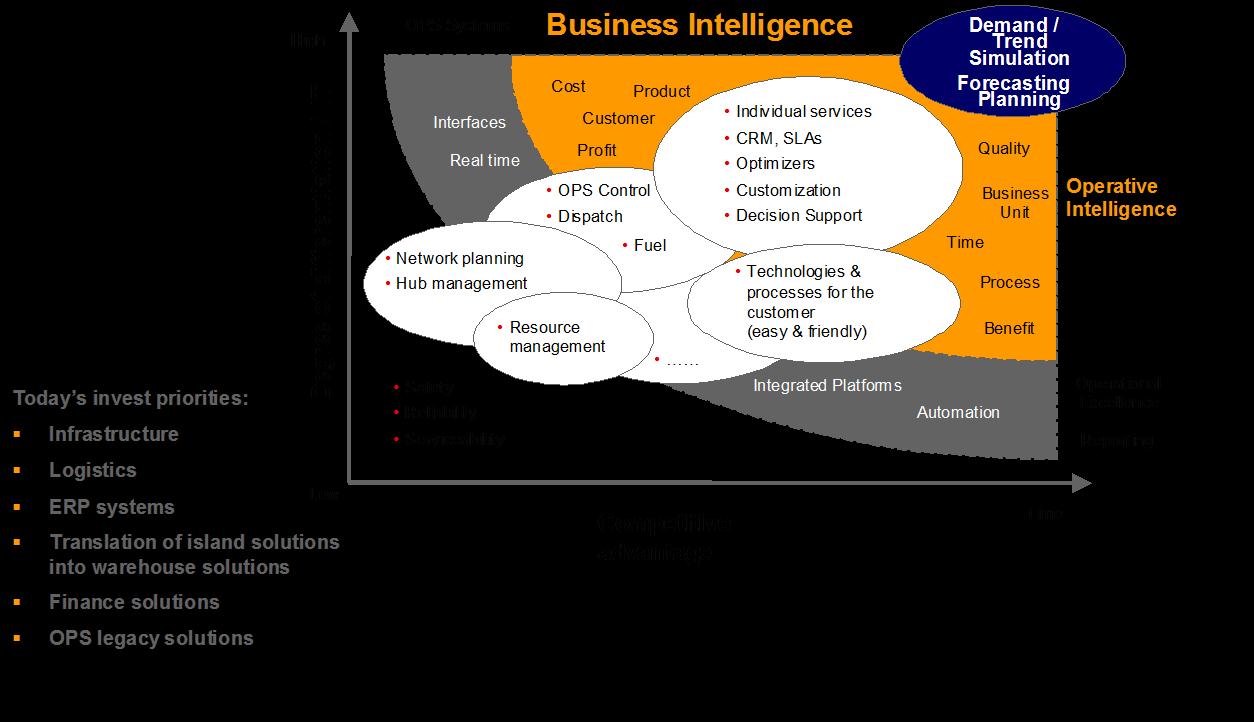

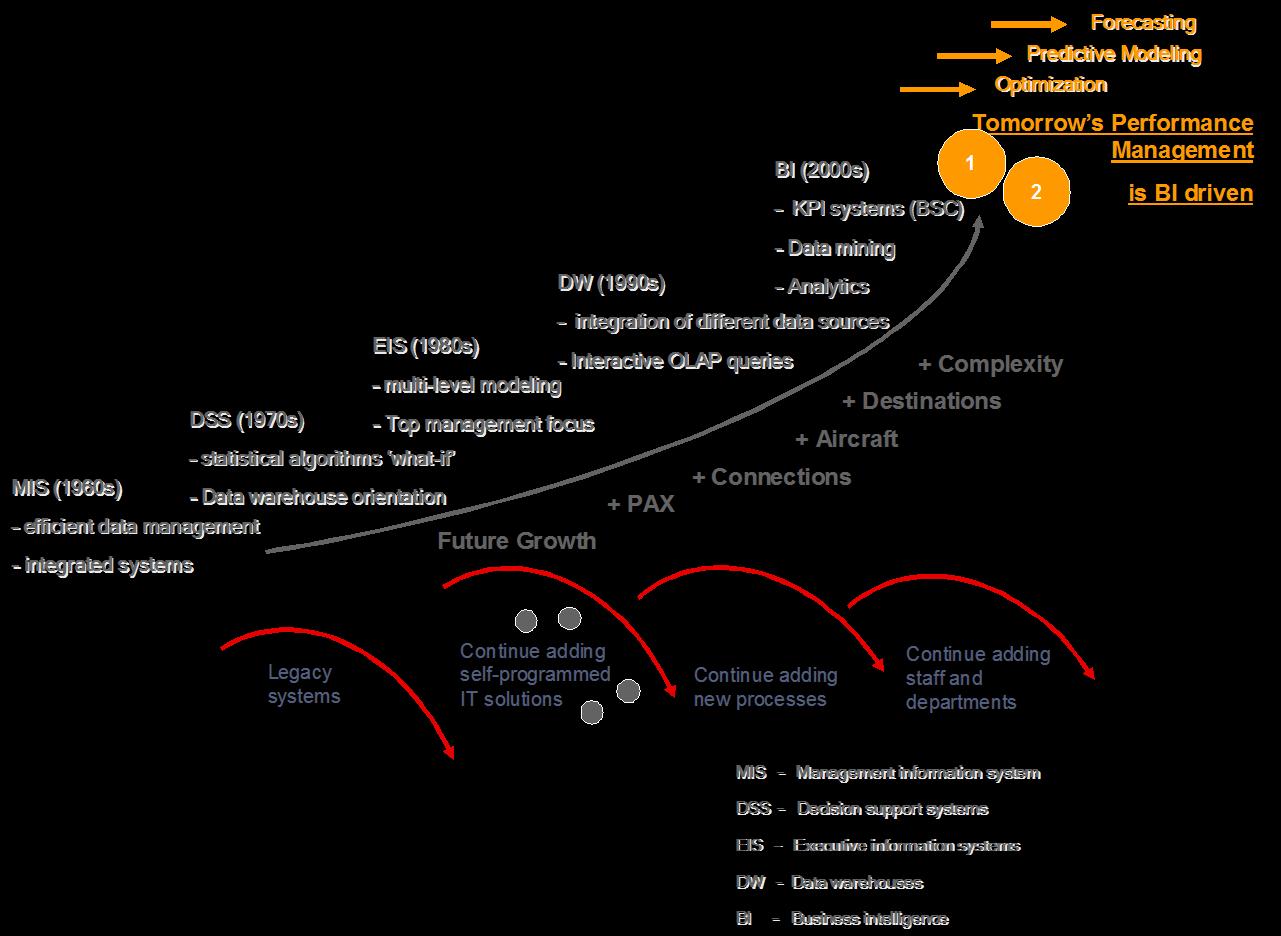

The Figure 1 shows the IT evolution layers for OPS solutions. Many of today’s airlines are still optimizing in the grey area. They are in a stage where OPS systems are in the focus and static reporting is applied. Also, many airlines still optimize their basic operation tools, whereas the leveraging that creates competitive advantage is in business and operative intelligence solutions.

Figure 1: The IT evolution path from operative excellence towards operative intelligence

Today, market cycles are growing ever shorter while customer expectations increase at an accelerating rate. At the same time the cycles of the developed competitive advantages get shorter as the competition goes low cost and hybrid. Cost cutting and flexibility have reached their limits and the industry now strives for ideas, innovation, exceptional products and services that supplement the continuously applied costing initiatives. To stay in the game, flexibility with fast operative and strategic decision making are crucial and they are expected to be fact based. This is why business intelligence (BI) solutions are gaining increasing presence in the aviation industry: BI handles massive amounts of data in seconds while, at the same time, allowing users to focus on analytics instead of data and information gathering.

Leadership and competitive advantage are generated or lost in Operations. Operations needs more than operative IT systems supporting operational excellence: Operations needs business intelligence – operative intelligence. Operations and performance management are the keys to success, they are where commercial, products and service strategies meet and come alive: this is where exceptional customer management can make a difference. Operations are also where the passenger meets the airline’s strategy; it is where you can tip a customer’s choice.

Airlines transport passengers from A to B, but they sometimes forget that their most important customers fly so often that they become very familiar with the airports. A frequent flyer arriving on, say, ‘stand A401’ may need to know whether he or she is going to make their connection: but it can seem that nobody else cares. The crew may not know the airport that well and will advise their customer to contact ground staff at the gate. It is exactly in this sort of situation where operative intelligence, with the knowledge and data available, can generate exceptional customer experiences. Today’s solutions will calculate walking time from this ‘stand A401’, via the terminal to the stand where the connecting flight is waiting – with alternative routes: they can even compare a ramp transfer against terminal transfer assistance, instead of leaving a frustrated passenger to their own devices. It is and will be Operations where preventive actions based on business intelligence will create a competitive advantage.

Today, business intelligence is not only ‘nice to have’; it is a ‘must have’. BI starts with: ‘you can’t manage what you can’t measure’… but BI is more than that. BI is: ‘if you do not know your business you can’t be competitive’, ‘if you do not know your strengths, weaknesses, opportunities and threats you will be developing strategy in the dark’. And if you develop strategy in the dark how can you serve today’s and tomorrow’s customers? Business intelligence is more than a tool for gathering data, it is more than smart analytics, BI has revolutionized and will continue to revolutionize management decisions, because smart analytics will even make delay codes ‘sexy’ to apply. They are the basis for early warning indicators when conflated with trend analytics and forecasting capabilities. Now is the time to roll out BI in Operations and apply it cross-functionally in inter-operational applications to support management while also smartening up real-time decision making. What supports management in decision making can’t be bad for operative decision making. Today’s data, KPIs and delay codes make their way into operations control centers to support real-time decisions. With real-time KPI systems, management and staff will apply the same KPIs: one target, one company for one goal. With BI, Operations gets empowered to manage the business, while managers focus on development of staff and the generation of competitive advantage.

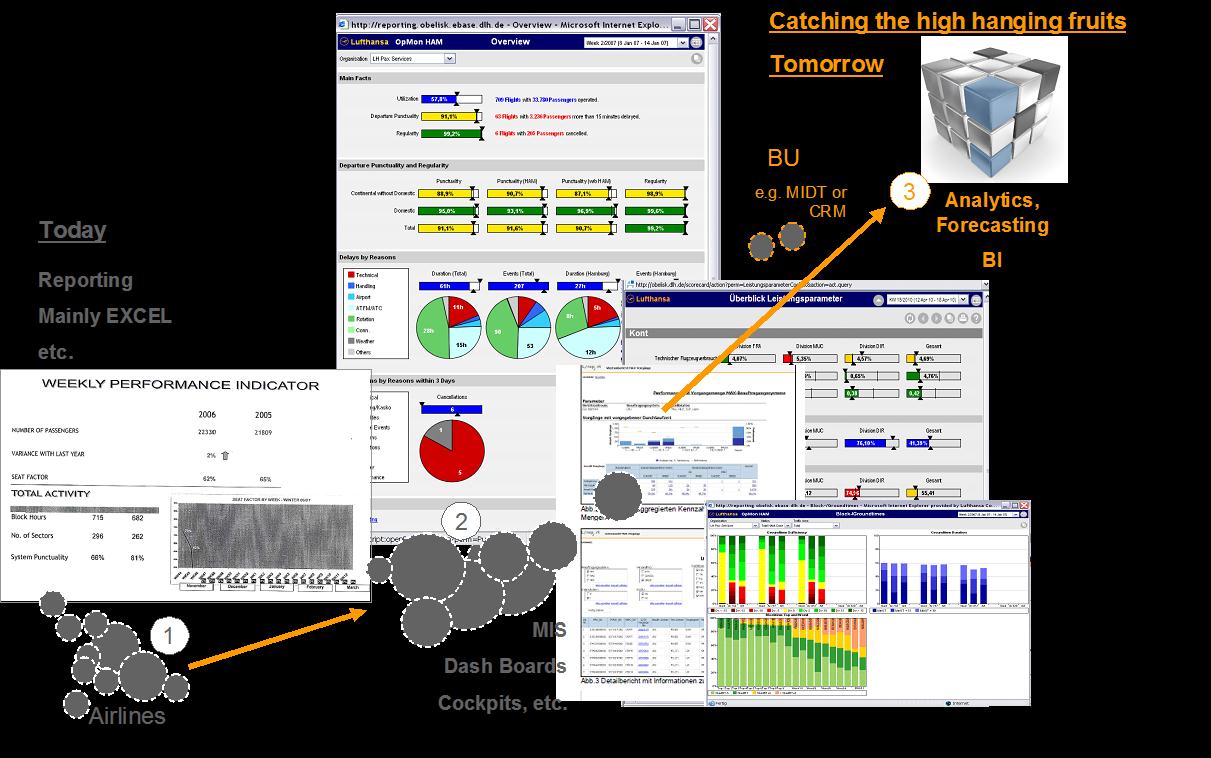

Figure 2: Catching the high hanging fruits with BI beyond reporting

Today, leading airlines correlate their company objectives on a cross-functional level by linking customer satisfaction with commercial, service and operative excellence. This cross functional approach allows the generation of further potentials: the season for catching the high hanging fruits is open.

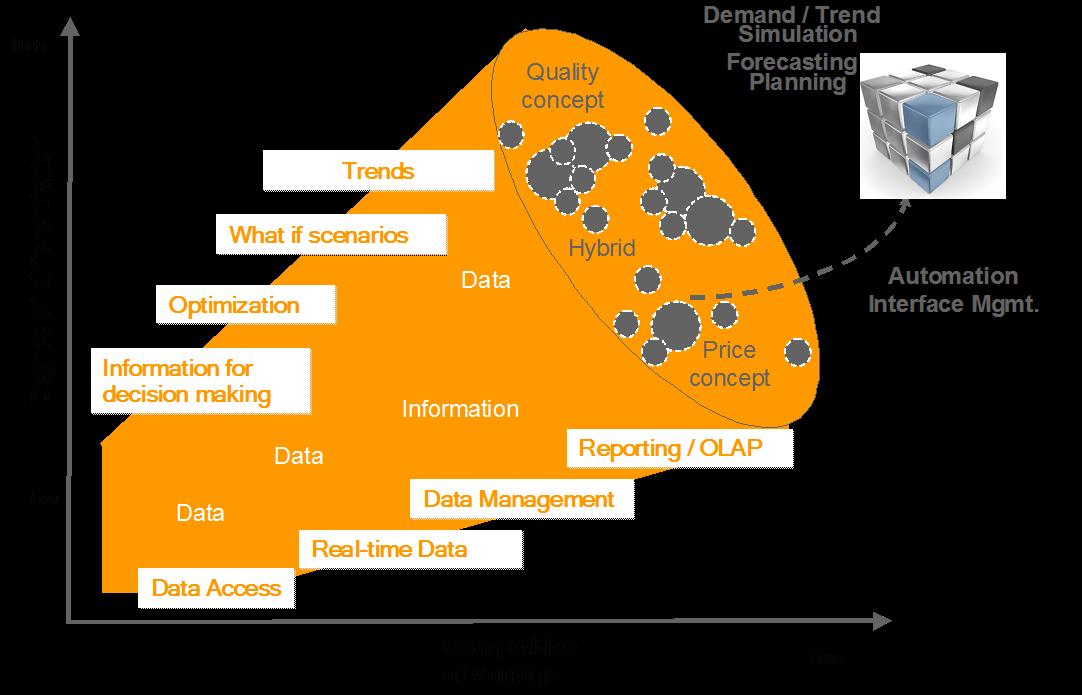

Figure 3: BI benefits and supports a cross functional management of performance

The prerequisite for moving from business excellence to business intelligence is a software and hardware package that allows real-time data management, trend analytics, etc. BI technologies provide historic, current, and predictive views on operations. Standard BI technologies cover reporting, analytics, data mining, business performance management,benchmarking, text mining, and predictive analytics. However, forecasting and simulations capabilities will the differential factor.

Figure 4: How BI technologies can support competitive advantage

Leveraging to create a competitive advantage, and tackle complexity and competing company objectives, is not defined by state-of-the-art solutions or tools. It is about the definition of performance metrics, concepts and methods to improve business decision making. Intelligence is not provided by the systems: rather, it is defined by the knowledge of the people working in the business and developed further via business analytics. Therefore the operative intelligence needs to be defined from within the company as a cross functional approach and it has to be supported by a progressive operations culture.

The consequence for delay reporting is that the units which have produced the delay codes and reports for management will be the same ones that will use re-engineered performance KPIs in their daily work to support decision making. Tomorrow’s static MIS will be translated into flexible real-time BI applications covering early warning indicators (EWI) or key disruption indicators (KDIs) integrated in dash boards.

Challenges and how to bridge them when going to BI

Modern BI systems are powerful; however, many airlines fail to generate bankable results with BI because a holistic BI strategy has not been developed before launch. A BI strategy should comprise more than just a new KPI reporting structure with a solid data and data warehouse model behind. In fact many airlines end up with the duplication of their current structures, while transferring their current data and reporting into a state of the art Management Information System (MIS) with faster and more automated aggregation of data instead of going to BI. Changing this takes a lot of effort, which adds nothing to the fruitless reporting implementation.

Many describe their MIS implementation as a BI solution, since everybody goes BI. But changing the word does not turn the ‘i’ in MIS into intelligence; it still stands for reporting ‘information’. BI benefits are only generated and sustainable if the BI concept is embedded in the corporate culture – making BI a living system which engages everyone, from top management to the loader, for the same goals. BI is about progressive management by objectives embedded in a learning organization, an organization which asks employees at all levels to contribute to change, innovation and best practice, and be eager to learn from mistakes.

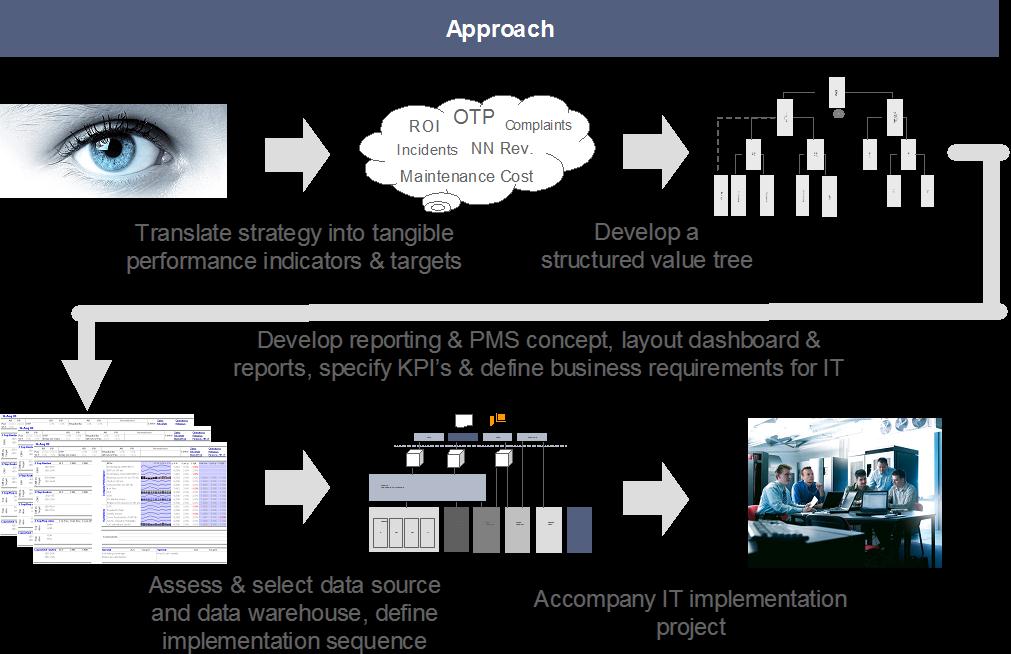

The other main challenge is about the lack of any guiding concept; the challenge is how the concept should be developed. Most of the time airlines plan to buy BI best practice solutions; the BI project is managed as an IT implementation. Therefore the IT vendor is made responsible for provision of a best practice solution. Many vendors provide reporting models, even during the sales pitch; they use the same reporting structure for this purpose. If such a BI solution is implemented, neither specifics nor specification of business requirements is taken into account. The responsibility for the BI concept – the business intelligence vision – is with the airline not the vendor. For best practice BI, airlines need a concept phase supplemented by a business process re-engineering (BPR) approach. At the same time, staff and management, working in cross-functional workshops, should develop analytics which support the business model of the operation. The concept needs to comprise and support an innovative, exceptional improvement management culture.

Airlines and MROs should be launching their business intelligence plans right now: it’s not a matter of following or adapting established BI best practices, at a later more mature stage. Neither is it a matter of waiting for a better BI upgrade to reach the market. Business intelligence is about continuous learning and improvement based on the data and information available in the company and, specifically, in Operations. A strategy of wait-and-see would leave the business as a sitting duck. Business skills, know-how and capabilities are within the company, not with a third party. Therefore the intelligence can only be translated into bankable results, if it is developed and continuously improved within the enterprise.

Best practice solutions need a holistic real-time concept for the company as a whole, and, specifically, for Operations control and Operations management. In the end the IT solution is selected based on the concept specification.

Figure 5: BI concept needs to translate corporate starategy into a BI concept

The BI Solution Market

Although BI has developed a strong and growing market presence in different industries over the last decade, BI solutions within the aviation industry are in their infancy. The solutions the industry applies have been individually and sporadically developed for specific analytical scopes. At many airlines, BI systems have been implemented based on the specific needs of certain business units, e.g. engine monitoring solutions, MIDT data analytics, etc. For the aviation industry this need not simply be a case of lagging behind the development of other industries; instead, it should be used as a chance to go not just for an IT solution, but for a holistic, integrated business intelligence concept.

In general BI solutions have been driven by IT departments. The motivation behind them was to gain advanced technical solutions to manage data and information. In most cases it wasn’t a business driven solution. BI solutions were also initiated by Finance for financial reporting, whereas Operations has not, traditionally, considered BI. This is why classic ERP providers like Oracle or SAP have a major stake in the BI solutions market. However, the result has been that traditional BI platform implementations have been top down and the solutions have been modeled in semantic layers. The focus was on reports and KPIs as well as dashboards / grids.

Today’s business has become intelligent. In general the decision to implement a BI solution has shifted towards the needs of the enterprise. It is the business which starts looking for solutions to deliver better visualization and analytics. Gartner, one of the world’s leading information technology research and advisory companies, states that the market shows that, for BI solutions, the ‘ease of use’ is so compelling that they get implemented despite the risk of creating fragmented silos of data, definitions and tools. Moreover, BI purchasing decisions are taken with or without the IT department’s consent. If BI is bought without consensus it works against the BI benefit of reducing complexity. If not contained and managed, BI solutions will add to complexity and not reduce it, creating business, strategy and performance islands, with different approaches and targets. As a consequence this would hinder the business performance instead of enhancing it: the need for a BI solution implementation complemented with a BI process, culture, organization and change concept grows increasingly compelling.

According to Gartner, IT organizations need to back away from a single-minded pursuit of standardization through one vendor. A more pragmatic portfolio approach would need to be developed to allow the generation of BI benefits. The challenge has been the integration of the new enterprise information management architectures and how to develop methodologies, and governance processes to accommodate and bridge the gap between the different buying centers, architectures and deployment approaches. According to Gartner, the target is a BI portfolio driven enterprise where IT departments and the business’s units support the integration of the different segments into an enterprise BI portfolio. The leading vision needs to be that both business user and enterprise requirements are met at the same time.

Gartner also states that a shift from measurement to analysis, forecasting and optimization takes place. This indicates that the competitive advantages shift from reporting to optimization. If airlines have not managed to structure their data and KPIs they will fall behind in analytics and even worse they will not develop the capability to develop that analytics driven corporate culture which is crucial for success.

Figure 6: Development stages of MIS towards BI

However, the application of the basic BI capabilities, like interactive visualization, predictive analytics, dashboards and online analytical processing (OLAP), is still increasing. Based on the Gartner research it is business users who push for analytics, forecasting and the optimization of the business processes. The market on the other side invests in statistical capabilities, predictive analytic modeling and forecasting algorithms.

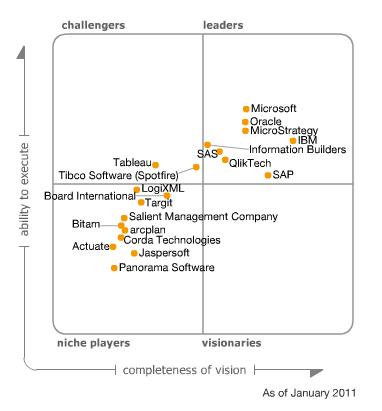

For a market overview of BI solutions, Gartner is the source of information. Annually Gartner publishes an evaluation of vendors in terms of completeness of vision and ability to execute. However good this guideline is, BI has reached a level where more and more BI software providers are entering the market with a range of solutions and concepts in addition to what is represented in Gartner’s Magic Quadrant. Today’s BI market offers not only numerous tools and concepts but also differential license fees, maintenance and operating concepts, with the consequence that the evaluation and selection of a BI solution becomes increasingly complex. However the Gartner rating of the leading BI solutions in the market gives an excellent indication.

Figure 7: Gartner’s Magic Quadrant for BI platforms

In terms of BI trends, Gartner assumes that organizations will apply BI tools for smarter, more agile and more efficient business performance. Therefore BI solutions will support companies with the analysis of large, volatile and diverse data in the future. Moreover, BI will serve as a knowledge base where Google-like users and analysts will explore vast amounts of increasingly diverse data types to detect patterns and optimize business processes and decisions. At the same time the need for information delivery systems will grow further. However, successful BI solutions will be embedded in the business process; BI will support real-time decisions, planning, simulation, and forecasting beyond what the basic dashboard and scorecard can deliver. For further details, refer to the Gartner report: ‘Magic Quadrant for Business Intelligence Platforms’ (issued 27 January 2011 by Rita L. Sallam, James Richardson, John Hagerty, Bill Hostmann).

Translating this into the aviation industry BI will be the tool with which airlines can differentiate their service, and commercial and operational excellence; giving each airline the flexibility and the option to customize a management tool to its needs. Operational tools will develop into basic tools to run Operations. However, the intelligence will be in the customized intelligence portals combining knowledge management, innovation management, safety and quality management with the company’s strategic goals that everybody follows.

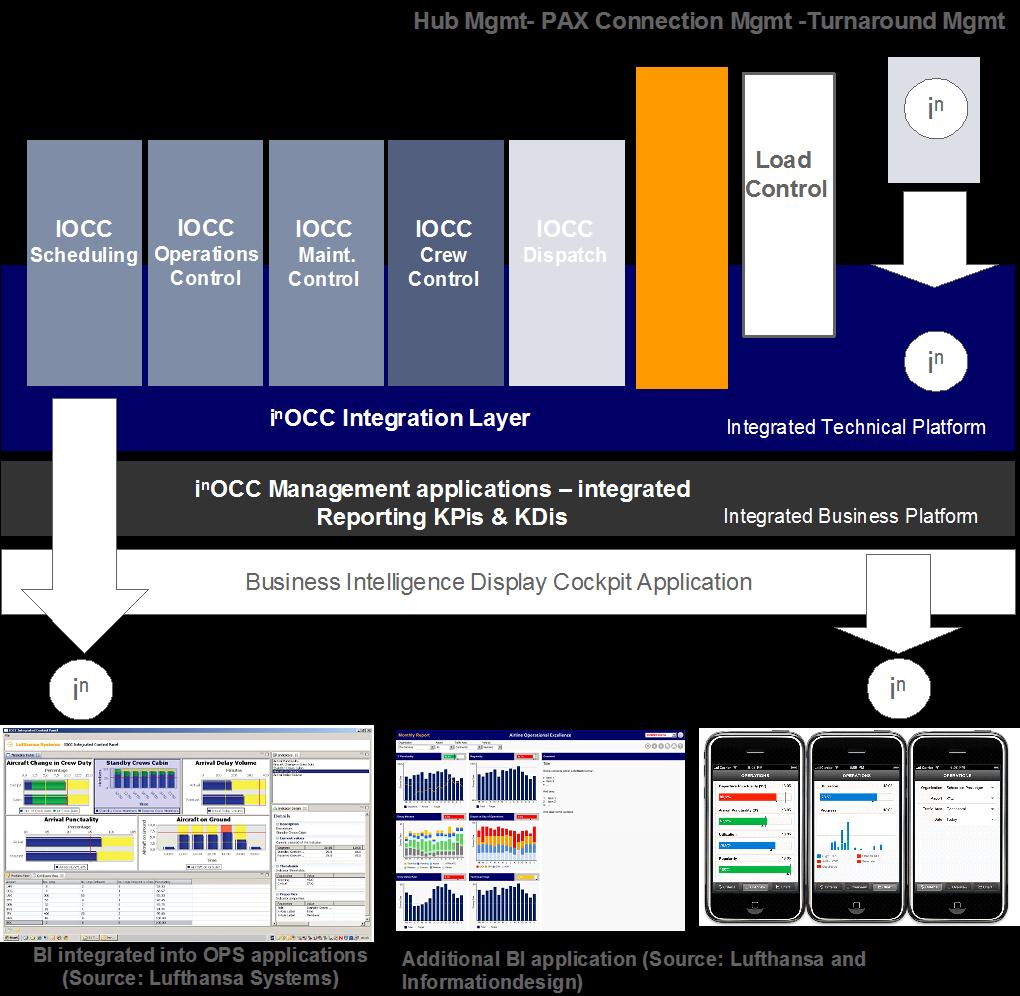

BI will change today’s Operations management and will determine the intelligence of tomorrow’s Operations control. It will forecast equipment changes, the cost and consequences of equipment changes, etc. and will be the future real-time supporting tool in operations control centers – hub (HCC), maintenance (MCC), operations (OCC), ground services (GCC) and airport (ACC) control centers.

It will be the airlines with the right IT, BI and operations concept who will lead the business. Those organizations that need to work collaboratively will especially gain from applying BI solutions for inter-organizational and inter-operational decisions. For airlines there are two different options available in the market for going BI. There are providers who offer the BI solution as a control panel integrated in the OPS system via an enterprise service bus (ESB). Going via an ESB, data flows can be fast tracked, offering one data model and giving airlines the flexibility and openness for innovation while ensuring operational stability. At the same time increasing numbers of BI providers are entering the aviation market and offering real-time capable BI solutions as an add-on solution.

Figure 8: Exemplary structure for real-time BI options

BI will leverage performance management initiatives. It will not only revolutionize IATA delay code reporting: tomorrow’s airlines will apply complex models for event and trend simulations, planning and forecasting. Airlines will apply predictive analytics with target thresholds for KPIs, early warning indicators and KDIs to allow analytics based alternative action management. The companies who manage to complement their BI by a performance driven and innovative corporate culture will outperform their peers.

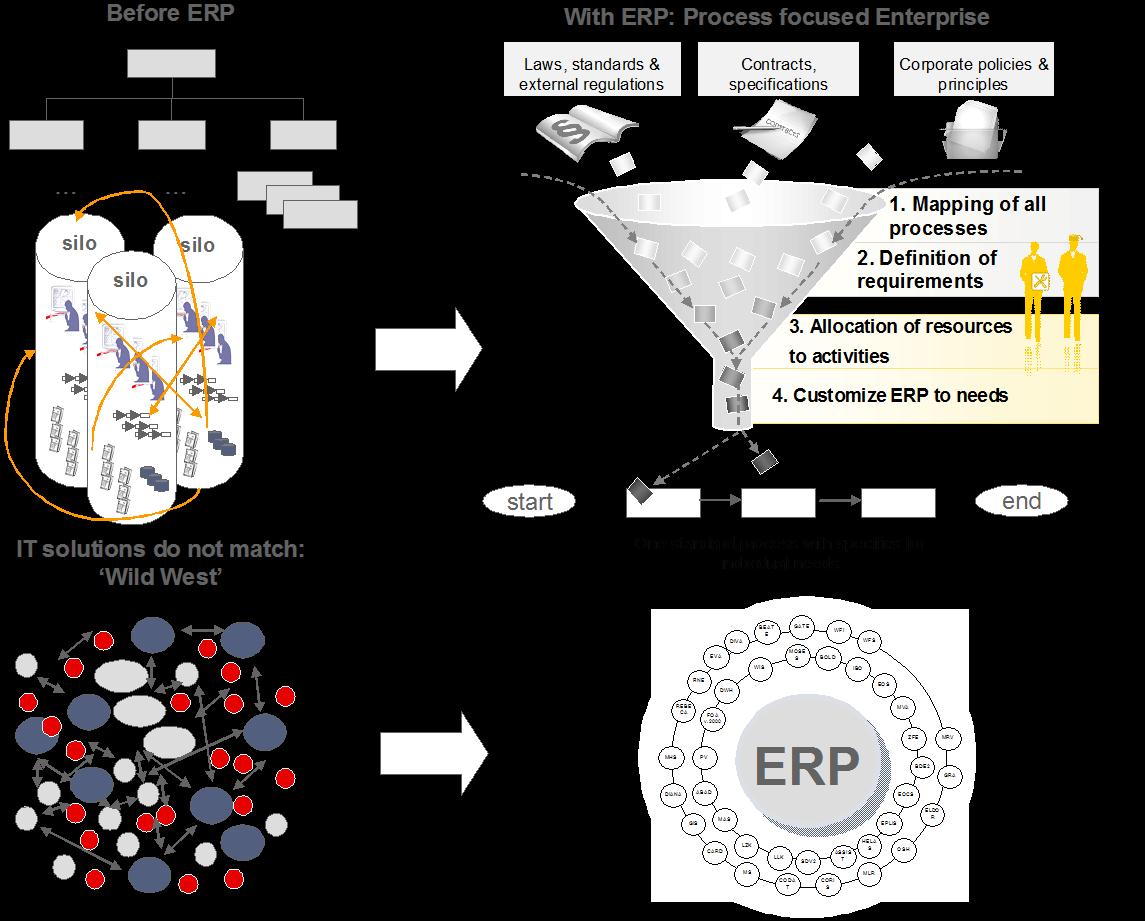

Repetition of history – a comparison of adopting BI against adopting ERP

As we understand it, the more BI solutions / island / silo solutions are added into a business, the more complex the BI and operative solutions management will be. Therefore the development of a holistic cross-functional business concept complemented by an IT strategy and architecture concept is essential.

Repetition of history? Today the IT landscape at MROs and airlines is extremely complex. To reduce complexity, ERP solutions have been introduced with the argument that ERP solutions integrate all departments and functions across a company into a single computer system that can serve all those different departments’ particular needs, thereby changing the company from a subsidiary / departmental (silo) approach to an enterprise one.

ERP solutions have added a lot of value to business. However, a lot of ERP implementations failed due to the lack of accompanying concept, business process re-engineering, change management, etc. Existing structures, processes, etc. have, too often, simply been transferred into the ERP systems without enhancements. There are companies that have not bought an ERP solution, but an expensive accounting system with not much value added compared to the cost. The thesis is that BI will face the same fate, if BI island solutions are not integrated into a strategic enterprise concept comparable with an ERP solution concept.

Figure 9: ERP objectives compared with BI objectives

Today, many airlines and MROs add individual BI solutions to their IT landscape without a holistic concept. This situation is comparable with the situation for ERP solutions ‘before ERP’. In a worst case scenario, the complexity is further complicated, because different BI solutions are added for single analytics (for one OPS system a BI reporting / analytics is added) and at the same time BI solutions are added on a cross-functional level (numerous OPS data sources are aggregated into a single BI reporting and analytics system). Without a holistic BI concept and process re-engineering approach the complexity will not be manageable and the optimization benefits will not be as high as they could be.

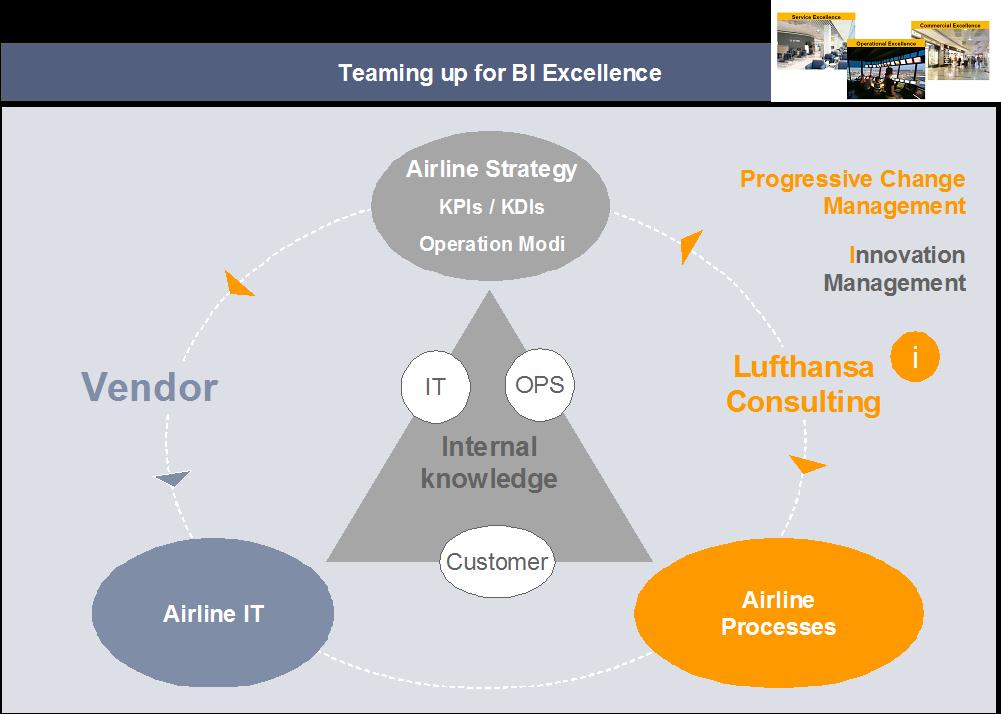

Airlines and MROs need to adopt BI now with a holistic real-time concept to outperform the competition and grasp a unique opportunity to create a continuous competitive advantage. Therefore the implementation needs to go beyond traditional IT / BI implementation workshops. BI needs to be complemented by a progressive change management concept, using the opportunity of going intelligent and innovative at the same time. Innovation is about thinking outside the box in a cross-functional company approach: however, tomorrow’s ideas will be generated by thinking outside the building, with the company plus third party partners.

Figure 10: Teaming up for BI with vendors and consultants

Comments (0)

There are currently no comments about this article.

To post a comment, please login or subscribe.